Quarterly financial statistics for enterprises, third quarter 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-11-23

$114.9 billion

Third quarter 2021

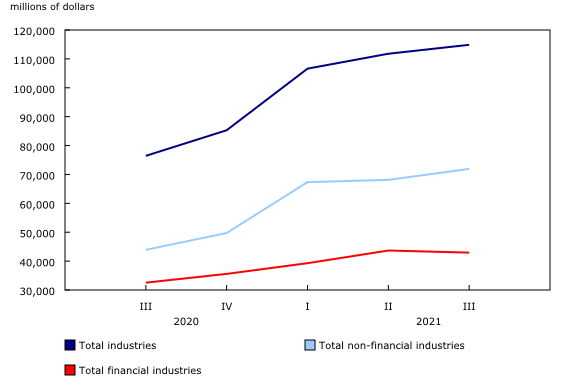

The Canadian corporate sector saw a quarterly increase of 2.8% in net income before taxes (NIBT) during the third quarter of 2021.

The non-financial sector drove the increase during the quarter, recording an increase of 5.6% in NIBT.

The financial sector offset some of the gains made by the non-financial sector, slipping 1.6% during the period. Through the quarter, businesses saw input prices and prices for raw materials rise as supply chains were disrupted across the world, and many advanced economies began to observe inflationary pressures.

Food producers faced higher prices as supply shortages were felt through the production chain

Late in the second quarter and early in the third quarter of 2021, Western Canada experienced a record-setting heatwave that fuelled wildfires and droughts, affecting the supply chain for food products.

As mentioned by Statistics Canada in model-based estimates of field crop in 2021, total grain and pulse production in the country is expected to see a sharp decline in 2021 due to adverse weather conditions and lower crop yields in the Prairie provinces. As some of these agricultural products were harvested in fall, the effect of decreased volumes may persist through the food products supply chain for months to come.

During the third quarter, the agriculture, forestry, fishing, and hunting industry saw a 41.2% decrease in NIBT.

As of 2018, 80.4% of inputs used in the manufacturing of food products were sourced domestically. Operating revenues for food and soft drink and ice manufacturers grew by $677.4 million, an increase of 1.7% from the second quarter of 2021. The before tax profit margin for the industry edged up 4.6 basis points, suggesting that increases in the cost of goods sold kept pace with revenue growth.

During the third quarter of 2021, food and soft drink and ice manufacturers saw their NIBT increase by $50.9 million, or 2.7%.

NIBT of wood product and paper manufacturers slipped as lumber prices fell

From July to September 2021, the lumber and other wood products component of the Industrial Product Price Index decreased by 20.0%, slipping from its peak in May 2021. Even as lumber prices fell, the price index for logs and bolts increased and reached an all-time high during the third quarter of 2021, in part due to high stumpage rates in British Columbia.

Production volumes of lumber fell in July as certain producers curtailed operations. Additionally, rail line damage inflicted by wildfires burning across British Columbia created backlogs which prevented wood products from reaching their intended markets. Though production and shipment volumes partly recovered in August, they remained below the levels recorded in August 2020. As a result, NIBT for wood product and paper manufacturing decreased 12.4% from the second quarter to the third quarter of 2021.

Dashboard now available

The Quarterly Survey of Financial Statistics: Visualization Tool is a comprehensive analytical tool that presents quarterly changes in the financial performance of enterprises.

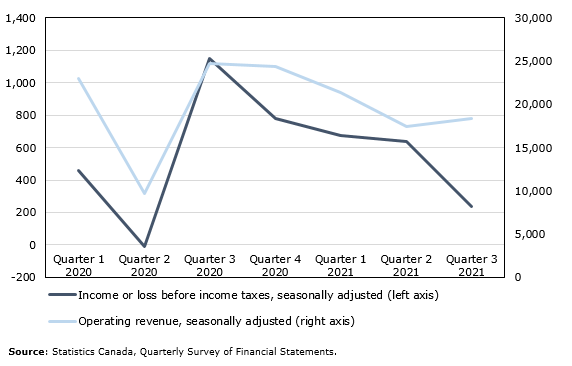

Financial overview of the motor vehicle and trailer manufacturing industry during the global pandemic

The COVID-19 pandemic has had an unprecedented impact on the financial performance of Canadian corporations. Operating revenue in the motor vehicle and trailer manufacturing industry declined by $4.6 billion (-20.0%) to $18.4 billion from the first quarter of 2020 to the third quarter of 2021. The negative impact on enterprise revenues was mainly caused by reduced operations, as well as a global shortage of semiconductor chips arising in the first quarter of 2021. This affected a wide array of electronic and computerized products, disrupting activities in the motor vehicle and trailer manufacturing industry. Despite the shortage of raw materials that negatively impacted the production of motor vehicles, net income before tax (NIBT) for the industry was recorded above pre-pandemic levels for the first and second quarters of 2021. Data from the Quarterly Survey of Financial Statements (QSFS), as well as data on sales from the Monthly Survey of Manufacturing (MSM) and on exports from the Canadian International Merchandise Trade Database were used to analyze developments in the motor vehicle and trailer manufacturing industry in 2020 and 2021.

The activities of the motor vehicle and trailer manufacturing industry rebounded following the onset of the pandemic

In the second quarter of 2020, NIBT for the motor vehicle and trailer manufacturing industry decreased by 101.7%. This decrease was mainly attributable to a decline (-57.5%) in operating revenues, as many automakers operated at limited capacity or ceased production entirely following public health restrictions, resulting in significant employee furloughs and layoffs.

According to the MSM, many auto assembly plants in Ontario shortened their scheduled shutdowns and maintenance as public health measures were relaxed in the third quarter of 2020. This resulted in higher capacity utilization as many enterprises in the motor vehicle manufacturing industry increased production in the third quarter of 2020 to meet the rapid increase in demand for new motor vehicles, as lockdown measures were partially relaxed during the summer of 2020. Because of this, the QSFS indicated that operating revenues of the motor vehicle and trailer manufacturing industry rose 153.8% and led to a sharp rebound (+$1.2 billion) in NIBT.

Shortage of semiconductor microchips exerted downward pressure on revenues for the motor vehicle and trailer manufacturing industry

COVID-19-related closures and shutdowns in 2020 further impacted the operations of the motor vehicle and trailer manufacturing industry by contributing to a shortage of semiconductors. To maximize profits, automakers have implemented measures to reduce waste and save costs by limiting inventories of parts (semiconductors included) to just-in-time manufacturing process—a production model where raw materials and components are ordered when needed. Consequently, when supply of motor vehicles declined for the industry as stay-at-home measures were mandated last year, demand for semiconductors by car manufacturers also decreased. Simultaneously, the shift to remote work and the associated need for connectivity resulted in significant demand for personal computers, smartphones and other electronic devices, all of them depending on semiconductors. As the demand for motor vehicles rebounded in the third quarter of 2020, semiconductor manufacturers were shifting production to higher-priced chips for electronic devices. This contributed to a shortage of chips for the automotive industry that disrupted their production in the first quarter of 2021.

In addition, the scarcity of microchips was partly exacerbated by the blockage of the Suez Canal in March 2021. Overall, operating revenue (QSFS) for the motor vehicle and trailer manufacturing industry was down by 12.4% in the first quarter of 2021 and by 18.2% in the second quarter.

Furthermore, as Canadian automakers slashed production, shortages of motor vehicles had a ripple effect on the level of exports for motor vehicles and parts which decreased by 6.7% in the first quarter of 2021 and by 16.6% in the second quarter, according to Canadian International Merchandise Trade.

NIBT remained above pre-pandemic levels for the first half of 2021, despite disruptions in raw materials

Despite a shortage of microchips and a decline in operating revenues in the first two quarters of 2021, NIBT of the motor vehicle and trailer manufacturing industry was above pre-pandemic levels in the first half of 2021. In the first quarter of 2021, NIBT rose 45.9% year over year to $674 million. This increase can be mainly attributed to higher profit margins for the industry. A reduced supply created greater demand for the cars and trucks being made, which increased competition for existing motor vehicles—customers were willing to pay the full sticker price—driving up the profit margins of motor vehicle manufacturers. Automakers were also able to increase their profit margins by shifting investment and production to more profitable lines of business: electric vehicles, self-driving cars, and full-sized pickup and SUV franchises.

Note to readers

Data from the Quarterly Survey of Financial Statements (QSFS) include amounts from government programs that support businesses, such as the Canada Emergency Wage Subsidy. These amounts are considered to be revenue for these businesses.

However, given lower response rates than historical averages, a potential delay in the release of this information by businesses and the methodology used to calculate QSFS estimates, use of these government support programs may be underestimated in the published data.

Data on quarterly net income before taxes in this release are seasonally adjusted and expressed in current dollars, unless otherwise stated.

For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Quarterly financial statistics for enterprises are based on a sample survey and represent the activities of all corporations in Canada, except those that are government-controlled or not for profit. The survey collects data on balance sheets, income statements and additional disclosures of enterprises.

An enterprise can be a single corporation or a family of corporations under common ownership or control, for which consolidated financial statements are produced.

Survey changes

The following changes were introduced to the survey starting with the first quarter of 2020:

- New content was implemented in the first quarter to align the survey with new accounting standards adopted by corporations starting in 2011.

- New industrial breakdowns were implemented, allowing for more granularity in the dissemination of data. As a result, some industry groupings were merged, others were split, and some remained the same.

- The survey sample was modified to support the new industrial breakdowns. However, a maximum sample overlap with the previous sample was adopted.

- A more automated imputation strategy was implemented to streamline the process and reduce the need for manual intervention.

Revisions, benchmarking and backcasting

The release of the QSFS in the third quarter of 2021 includes revised estimates for the first and second quarter of 2021.

Efforts are being made to backcast these data to the first quarter of 2010 to allow for better historical comparisons. However, as more than one cycle of new content is required before this exercise can begin, users are encouraged to use caution when making historical comparisons.

It is expected that backcasting will be completed and results released at the end of 2021.

Larger-than-usual revisions may be anticipated in the future, as quarterly revisions, annual benchmarking, backcasting and new survey data received from respondents will be incorporated to improve data quality and include the most up-to-date data.

Business performance and ownership statistics portal

The Business performance and ownership statistics portal, accessible from the Subjects module of our website, provides users with a single point of access to a wide variety of information on business performance and ownership in Canada.

Next release

Financial statistics for enterprises for the fourth quarter of 2021 will be released on February 23, 2022.

Products

Aggregate balance sheet and income statement data for Canadian corporations are now available.

Data from the Quarterly Survey of Financial Statements are also available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: