Employment Insurance, May 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-07-22

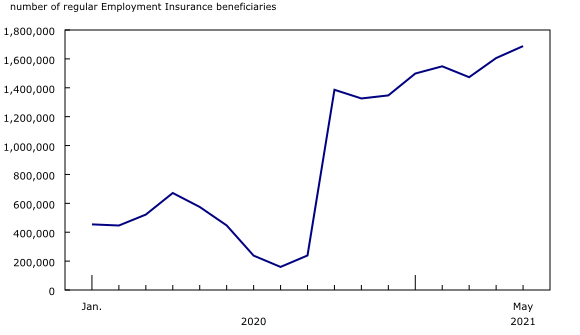

Approximately 1.7 million Canadians received regular Employment Insurance (EI) benefits in May, up 83,000 (+5.2%) from a month earlier. Nova Scotia, Alberta and British Columbia reported the largest increases in beneficiaries.

May EI statistics reflect labour market conditions as of the week of May 9 to 15.

Ahead of the reference week, tighter public health measures continued or were introduced in several provinces.

In Ontario, a stay-at-home order implemented on April 8 continued, affecting many non-essential businesses. Both Alberta and Manitoba introduced measures that included the closure of personal care services, recreational facilities and in-person dining, as well as limits on retail store capacity. Nova Scotia entered a province-wide shutdown on April 28 that closed non-essential retail stores, followed by tightened measures at the provincial border on May 10. In contrast, public health measures were eased in some regions of New Brunswick and Quebec in late April and early May.

More Canadians collect regular EI benefits in May

Approximately 1.7 million Canadians received regular EI benefits in May, up 83,000 (+5.2%) from a month earlier.

According to the Labour Force Survey (LFS), employment fell by 68,000 in May, while unemployment held steady at 1.7 million, including 1.4 million Canadians who were looking for work and 200,000 who had a connection to a job, either because they were on temporary layoff or had arrangements to begin a new job in the near future.

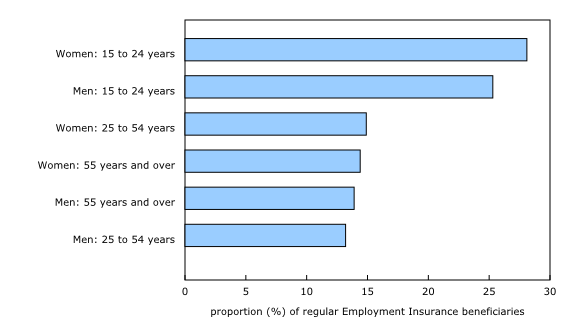

Young women more likely than other age groups to qualify for regular EI under the new rules

In late September 2020, temporary changes to the EI program, including a reduction in the number of insured hours required to qualify for benefits, were introduced to increase EI eligibility. In May, 16.2% of regular EI recipients—including more than one-quarter (28.1%) of young women aged 15 to 24—qualified under these new eligibility criteria (not seasonally adjusted). Almost one-fifth (19.0%) of regular EI recipients who last worked in retail trade qualified for the program under the new rules (not seasonally adjusted).

The increase in regular EI beneficiaries concentrated in Nova Scotia, Alberta and British Columbia

The number of regular EI beneficiaries rose in eight provinces in May, led by Nova Scotia (+24,000; +47.0%), Alberta (+23,000; +12.6%) and British Columbia (+17,000; +9.4%), reflecting tightened public health measures in these provinces. May LFS results indicated that employment fell in Nova Scotia (-22,000; -4.8%) and was little changed in Alberta and British Columbia.

At the same time, there were fewer regular EI beneficiaries in Ontario (-7,000; -1.1%), while Newfoundland and Labrador showed little change.

On a regional basis, the census metropolitan areas of Calgary, Halifax and Vancouver accounted for more than one-third (34.7%) of the monthly increase in regular EI beneficiaries.

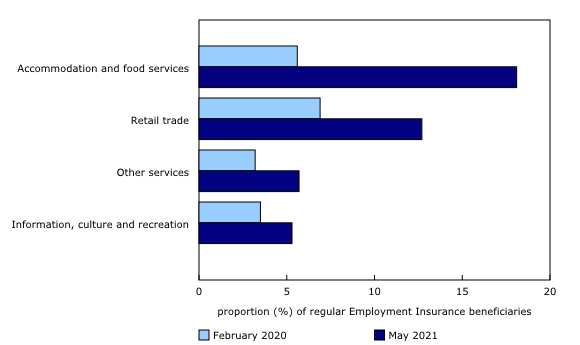

Just over two in five regular EI recipients worked in industries providing in-person services

In May, more than two in five (41.8%) regular EI recipients last worked in one of four industries providing in-person services, including 18.1% in accommodation and food services; 12.7% in retail trade; 5.7% in other services; and 5.3% in information, culture and recreation (not seasonally adjusted). Further illustrating the impact of the pandemic response measures, May LFS results showed that employment in these same industries was below pre-COVID levels by a total of 664,000.

Women account for all of the monthly increase in regular EI recipients

In May, 88,000 (+10.5%) more women received regular EI benefits compared with a month earlier, while there was little change among men. This is consistent with May LFS results, which showed that employment among women fell by 54,000, while there was little change among men. Women accounted for more than half of regular EI beneficiaries in each of the three main age groups, compared with about one-third in February 2020.

Youth aged 15 to 24 accounted for 16.9% of total regular EI recipients in May, up from 9.1% in February 2020. The share of young women (+10.5 percentage points) collecting regular EI benefits has grown at almost twice the pace of young men (+5.6 percentage points) over this period. June LFS results indicated that, compared with February 2020, employment was down by a similar proportion for young women (-72,000; -5.6%) and young men (-54,000; -4.1%). From November 2020 to May 2021, employment was further from pre-COVID levels for young women than for young men.

Long-term unemployment reflected in EI benefits

May LFS results indicated that the number of long-term unemployed Canadians continued to increase in May, as many of those who lost their jobs in the spring, summer or fall of 2020 remained unemployed. Almost one-third (28.9%) of all unemployed in May had been without work for 27 weeks or more, compared with 15.6% in February 2020.

The challenges faced by many workers in returning to employment are also reflected in EI data. In May, almost two-thirds (65.4%) of regular EI recipients had received regular EI benefits or the Canada Emergency Response Benefit (CERB) in at least 7 of the last 12 months, up from 16.1% in February 2020 (not seasonally adjusted).

Among these longer-term regular EI recipients, just over half (50.6%) were women and 57.9% were core-aged (aged 25 to 54 years) (not seasonally adjusted). By province, the proportion of EI recipients who had received regular EI or CERB benefits in at least 7 of the last 12 months ranged from 69.1% in Newfoundland and Labrador to 59.9% in Nova Scotia (not seasonally adjusted).

Next release

June EI results will reflect the impact on regular EI recipients following the easing of public health measures in several provinces since late May.

Sustainable Development Goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development, the United Nations' transformative plan of action that addresses urgent global challenges over the following 15 years. The plan is based on 17 specific sustainable development goals.

Employment Insurance statistics are an example of how Statistics Canada supports reporting on global sustainable development goals. This release will be used to help measure the following goal:

Note to readers

Employment Insurance in the context of broader COVID-19 benefit programs

No methodological changes were made to the Employment Insurance Statistics (EIS) program over the COVID-19 pandemic period. EIS reflect the Employment Insurance (EI) program for the Labour Force Survey (LFS) reference week in each month.

Data for the October 2020 reference period and onward comprise individuals who obtained EI benefits, and exclude beneficiaries of the Canada recovery benefits (Canada Recovery Benefit, Canada Recovery Caregiving Benefit, and Canada Recovery Sickness Benefit).

Concepts and methodology

The analysis focuses on people who received regular EI benefits related to job loss.

EI statistics are produced from administrative data sources provided by Service Canada and Employment and Social Development Canada. These statistics may, from time to time, be affected by changes to the Employment Insurance Act or administrative procedures.

EI statistics indicate the number of people who received EI benefits and should not be confused with LFS data, which provide estimates of the total number of unemployed people. There is always a certain proportion of unemployed people who do not qualify for benefits. Some unemployed people have not contributed to the program because they have not worked in the past 12 months or their employment was not insured. Other unemployed people have contributed to the program, but do not meet the eligibility criteria, such as workers who left their jobs voluntarily or those who did not accumulate enough hours of work to receive benefits.

All data in this release are seasonally adjusted, unless otherwise specified. Values for all series from March 2020 to May 2021 have been treated as outliers in determining a seasonal pattern for seasonal adjustment. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

The number of regular EI beneficiaries for the current month and the previous month is subject to revision.

The number of beneficiaries is a measure of all people who received regular EI benefits from May 9 to 15. This period coincides with the reference week of the LFS.

Beneficiaries who qualified for EI under the new EI rules introduced in September 2020

Temporary changes to the EI program that provided all new regular EI beneficiaries with a one-time credit of 300 insurable hours were introduced on September 27, 2020. In addition, the unemployment rate used to calculate their eligibility and entitlement weeks was 13.1%, unless their region's unemployment rate was higher.

This supplementary indicator presents the number of individuals who qualified for EI only as a result of these program changes.

EI beneficiaries by industry

The industry of EI beneficiaries is determined by integrating EI data with record of employment administrative data. For beneficiaries with more than one record of employment in the past 52 weeks, the records with the greatest number of hours are used. If no industry information can be found, industry information is deemed "Not classified" for the beneficiary.

EI beneficiaries by number of months on EI or Canada Emergency Response Benefit over the previous 12 months

This supplementary indicator presents the number of regular EI recipients who received either regular EI benefits or the Canada Emergency Response Benefit (CERB) for a defined number of total months over the previous 12 months.

A census metropolitan area (CMA) or census agglomeration (CA) is formed by one or more adjacent municipalities centred on a population centre. A CMA must have a total population of at least 100,000. A CA must have a population of at least 10,000. See Standard Geographical Classification 2016 – Definitions for more information.

Data availability

Data tables 14-10-0336 and 14-10-0337 remain suspended as of the December 2019 reference period, because of occupational coding issues from the source data file. Work is ongoing to identify a solution to continue publishing the tables.

Data tables 14-10-0004, 14-10-0005, 14-10-0007 and 14-10-0008 remain suspended as of the March 2020 reference period because a source data file contains records for CERB claimants and beneficiaries who could not be identified and excluded through processing.

In the data table 14-10-0009, for the March 2020 to September 2020 reference periods, subaggregates of the parent "regular benefits" benefit type have been suppressed because of data quality.

Next release

Data on EI for June will be released on August 19.

Products

More information about the concepts and use of Employment Insurance statistics is available in the Guide to Employment Insurance Statistics (73-506-G).

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: