New Housing Price Index, June 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-07-21

June 2021

0.6%

(monthly change)

June 2021

0.5%

(monthly change)

June 2021

0.0%

(monthly change)

June 2021

0.0%

(monthly change)

June 2021

1.6%

(monthly change)

June 2021

0.7%

(monthly change)

June 2021

0.6%

(monthly change)

June 2021

1.9%

(monthly change)

June 2021

1.8%

(monthly change)

June 2021

2.0%

(monthly change)

June 2021

-0.2%

(monthly change)

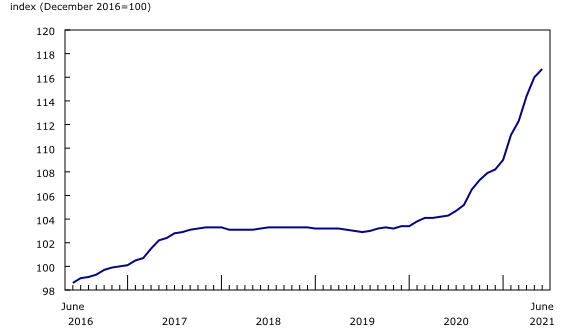

The growth in new home prices slowed for a second month in a row, rising by 0.6% in June, the smallest increase in six months.

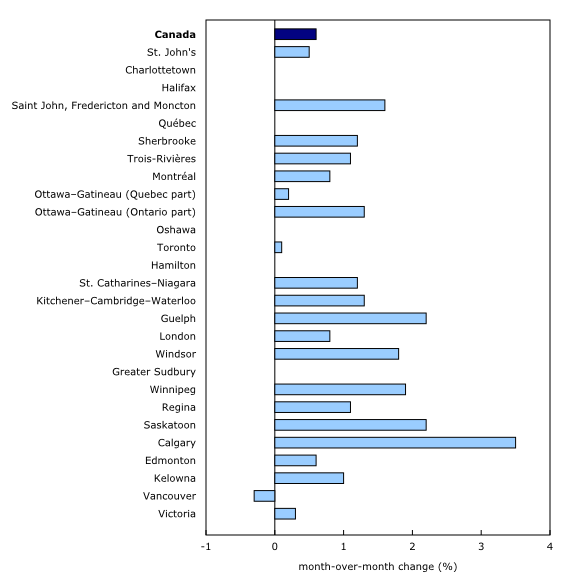

New Housing Price Index, monthly change

Calgary (+3.5%) reported the largest monthly increase in new home prices in June. Employment gains may have driven up the demand for housing, by allowing more people to enter the market. There were 59,100 more people working in Calgary in June compared with the same month a year earlier. Although employment in Alberta has not yet returned to pre-pandemic levels, there is evidence of recovery as most industries, including mining, quarrying, and oil and gas, employed more people in June 2021 than in June of last year.

New house prices also increased in Guelph and Saskatoon (both up 2.2%). According to the Canadian Real Estate Association, on a year-over-year basis, new and resale home sales in Guelph were 13.9% above the five-year average in June. New listings also trended upward (0.9% above the five-year average), but not enough to keep pace with demand, which continued to contribute to the price increases. Saskatoon also experienced a rise in home sales (+15.9%) in June compared with the same month a year ago. Inventory remained tight in both census metropolitan areas (CMAs).

Among the 27 CMAs surveyed, Vancouver (-0.3%) recorded the only decline in new home prices in June. The benchmark price for all residential properties in the Greater Vancouver Area rose 0.2%, a deceleration from the 1.5% increase in May and the third consecutive deceleration.

Markets show signs of moderating nationally

Although the Canadian housing market remains near record-high sales levels, signs of moderation have begun to appear over the past few months. June (-0.7%) marked the third consecutive decrease in new listings nationally, with declines in half of all local markets. Sales activity was also down in 92% of all local markets on a month-over-month basis, according to the Canadian Real Estate Association. Further decreases in home prices may be observed in the fall if the number of sales continues to decrease faster than available listings.

The current market slowdown, partly due to buyer fatigue, has started to manifest in the housing market, with fewer buyers ready to engage in bidding wars. As well, the desire to buy a home could start subsiding as pandemic measures are lifted and many workers return to offices.

New Housing Price Index, 12-month change

Despite the month-over-month deceleration in new house price increases, year-over-year gains remained near record highs (+11.9%) in June.

New home prices were up in all 27 CMAs on an annual basis, with the largest increases in Kitchener–Cambridge–Waterloo (+27.7%), Ottawa (+26.2%), Windsor (+22.8%) and Montréal (+19.9%). These are the largest annual accelerations for these four CMAs since the beginning of the New Housing Price Index in February 1981.

Note to readers

The New Housing Price Index (NHPI) measures changes over time in the selling prices of new residential houses. The prices are those agreed upon between the contractor and the buyer at the time the contract is signed. The detailed specifications for each new house remain the same between two consecutive periods.

The prices collected from builders and included in the index are market selling prices less value-added taxes, such as the federal goods and services tax and the provincial harmonized sales tax.

The survey covers the following dwelling types: new single homes, semi-detached homes and townhomes (row or garden homes). The index is available at the national and provincial levels and for 27 census metropolitan areas (CMAs).

The index is not subject to revision and is not seasonally adjusted.

In addition to this monthly release, the NHPI has also been integrated into the Residential Property Price Index (see Methodology of the Residential Property Price Index (RPPI)). The RPPI is a quarterly series that measures changes over time in the prices of residential properties for Montréal, Ottawa, Toronto, Calgary, Vancouver and Victoria. An aggregate for these six CMAs is also available. The RPPI provides a price index for all components of the housing real estate market—new and resale—in addition to a breakdown between houses and condominium apartments.

Products

The article "The resilience and strength of the new housing market during the pandemic" examines the changes in new home prices in Canada for the 27 surveyed CMAs captured in the NHPI and compares the ranking of cities based on prices six months into the pandemic (August 2020 compared with February 2020).

The article "Price trends and outlook in key Canadian housing markets" looks at where the housing market was at the onset of the COVID-19 pandemic, sheds light on what has happened since then and explores the challenges of the Canadian market going forward.

The infographic "The impact of COVID-19 on Key Housing Markets," part of the series Statistics Canada — Infographics (11-627-M), is available. It provides an outlook on the housing market before, during and after the onset of the COVID-19 pandemic.

The "New Housing Price Index: Interactive Dashboard," which allows users to visualize statistics on new housing prices, is available.

The "Housing Market Indicators" dashboard, which provides access to key housing market indicators for Canada, by province and by CMA, is also available.

For more information on the topic of housing, visit the Housing Statistics Portal.

The video "Producer Price Indexes" is available on the Statistics Canada Training Institute web page. It provides an introduction to Statistics Canada's Producer Price Indexes—what they are, how they are compiled, and what they are used for.

Statistics Canada launched the Producer Price Indexes Portal as part of a suite of portals for prices and price indexes. It provides users with a single point of access to a wide variety of statistics and measures related to producer prices.

Next release

The New Housing Price Index for July will be released on August 20.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: