Survey of Maintenance Enforcement Programs: Child and spousal support, 2019/2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-05-28

More than 80% of money owed for child and spousal support collected in 2019/2020

In 2019/2020, 81% of the money owed for child and spousal support to recipients registered in a subset of provincial and territorial Maintenance Enforcement Programs (MEPs) was collected. This was up 1 percentage point from a year earlier. The highest collection rate for support cases was in New Brunswick (98%), and the lowest was in Saskatchewan (73%).

When a union dissolves, parties may have a registered separation agreement or obtain a court order dealing with child support or spousal support. Provincial and territorial MEPs exist across Canada to assist recipients in collecting and enforcing child and spousal support payments. Requirements for registration in MEPs vary across provinces and territories.

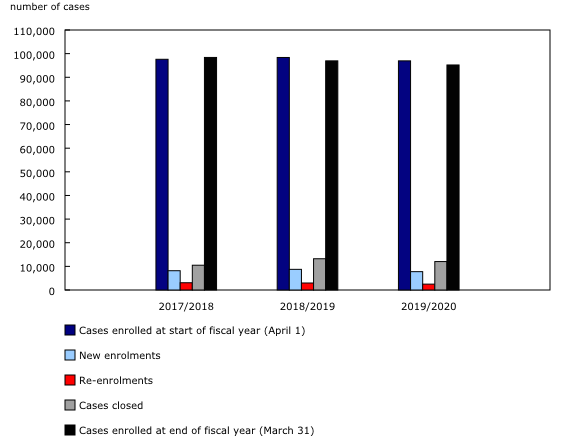

According to results from the most recent Survey of Maintenance Enforcement Programs, which covers five provinces and two territories, on March 31, 2020, there were 95,200 child and spousal financial support cases registered with MEPs in those jurisdictions, down 1.8% from the previous year. Alberta reported the sole increase in caseload (+1.1%).

While this information was collected prior to the COVID-19 pandemic, it provides insight into trends before the economic downturn brought on by the pandemic, which may impact compliance with child and spousal support payments.

Collection rates highest for spouse-only beneficiary cases and for older payors

In 69% of registered support cases, children were the only beneficiaries. Cases with spouses as the only beneficiaries made up 4% of the caseload in 2019/2020, while cases that included both child and spousal support accounted for 3%. In the remaining 24% of support cases, the type of beneficiary was not reported.

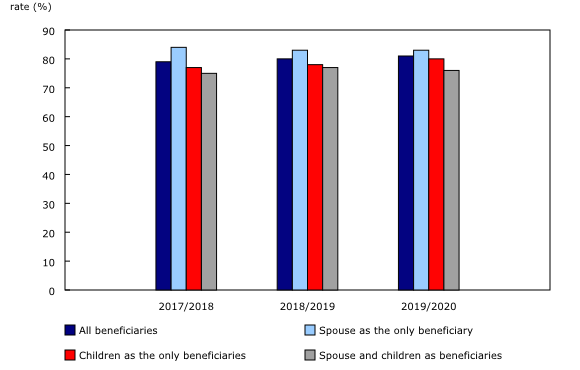

While 81% of all money owed for child and spousal support was collected in 2019/2020, collection rates varied based on the type of beneficiary named in the support order. Cases that included only spousal support had slightly higher collection rates (83%) compared with cases that solely included child support (80%). The collection rate for payments that were to provide both spousal and child support was lowest, at 76%.

Collection rates also varied according to the age and sex of the payors. The highest payment collection rates were from men (93%) and women (92%) payors aged older than 65, while the lowest were from men (61%) and women (50%) payors aged 15 to 24. This may be related to the financial means of younger people whose unions have dissolved.

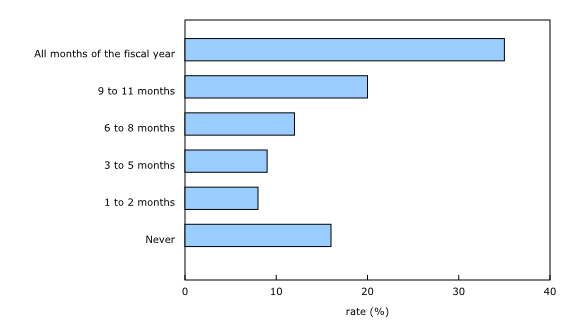

In fewer than 4 in 10 cases, support payments are made in full each month for the entire year

In 2019/2020, fewer than 4 in 10 registered support cases (35%) were in full compliance with payment, meaning the beneficiaries received the amount that was owed to them in every month of the fiscal year. This proportion was relatively unchanged from the previous year (36%). The remaining support cases recorded various degrees of payment compliance, with beneficiaries not receiving full support payments in at least 1 month and up to 12 months throughout the year.

Newfoundland and Labrador (44%) and New Brunswick (42%) reported the highest full payment compliance rates (all payments made in full each month) for support cases among all reporting jurisdictions, while Saskatchewan (19%) and the Northwest Territories (18%) had the lowest.

Nearly two-thirds of support cases start the year in arrears, up slightly from a year earlier

In 2019/2020, 50,295 child and spousal support cases (65%) started the year in arrears, meaning there was money owing from previous missed payments. This was up 110 cases from the previous fiscal year. Data on arrears include only those cases that were enrolled for the full year and exclude cases with support payments made outside the jurisdiction in which the order is registered.

In almost half (47%) of the cases that started the year in arrears, the amount of money owing from previous missed payments increased over the course of the year. Almost the same proportion (45%) of cases reported the opposite trend, with arrears declining or being eliminated by the end of the year. Arrears in child and spousal support payment were unchanged in the remaining 7% of cases.

The majority (84%) of registered support cases that started the year with no money owed from previous payments also ended the year with no arrears. By comparison, 16% of support cases that had no arrears at the beginning of the year accumulated them throughout the year.

Note to readers

The Survey of Maintenance Enforcement Programs (SMEP) collects information on child and spousal support payments and cases from provincial and territorial Maintenance Enforcement Programs. These programs exist across Canada to assist recipients in collecting and enforcing child and spousal support payments. Survey data provide information on the volume and types of cases enrolled, support amounts due, compliance with support payments, and enforcement actions, among other measures.

The data reflect only those jurisdictions that report to the SMEP: Prince Edward Island, Nova Scotia, New Brunswick, Saskatchewan, Alberta, the Northwest Territories, Yukon, and Newfoundland and Labrador.

Collection rates for child and spousal support payments were calculated by dividing the amounts received over the fiscal year by the total amounts that were due. A rate of 100% would mean that all of the money owed was received.

For the purpose of the SMEP, compliance means that at least the amount expected in a month is received by the beneficiary. Cases in compliance may also have arrears (money owing from earlier missed payments), as the determination of compliance is made only against the current amount due in a month. It is therefore possible for a support case to have arrears but still be in compliance with total expected payments for a given month. The full compliance rate is the percentage of support cases in which payment was made in full.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: