Wholesale Services Price Index, fourth quarter 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-04-09

Petroleum and petroleum product merchant wholesalers fuel first margin increase in three quarters

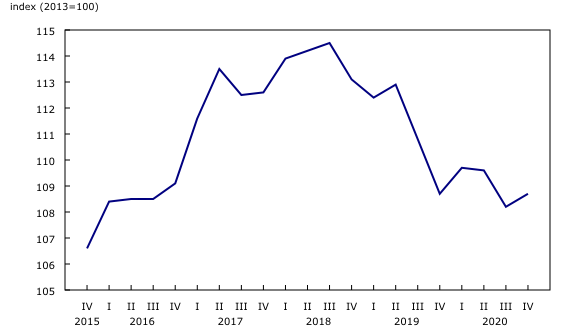

In the context of the economy's continued reopening in the fourth quarter, the Wholesale Services Price Index (WSPI) rose 0.5%, led primarily by petroleum and petroleum product merchant wholesalers (+12.8%).

Merchant wholesalers in the building material and supplies subsector (+1.0%) also contributed to the rise, as margins increased at metal service centres (+2.8%) and in lumber, millwork, hardware and other building supplies (+0.7%) industries.

Machinery, equipment and supplies (+0.5%) and personal and household goods (+0.2%) merchant wholesalers also contributed to the growth.

Partially offsetting the increase in the WSPI were declines in the subsectors of food, beverage and tobacco (-1.7%), motor vehicle and motor vehicle parts and accessories (-0.9%), miscellaneous (-0.2%), and farm product (-0.5%).

Margins unchanged year over year

Year over year, wholesale margins were unchanged (0.0%) in the fourth quarter. The machinery, equipment and supplies (+3.6%) and food, beverage and tobacco (+4.5%) subsectors recorded the largest growth.

Merchant wholesalers in the farm product (+7.6%) and miscellaneous (+0.3%) subsectors also reported higher margins.

Petroleum products merchant wholesalers reported the largest decrease, down 18.1% year over year. While there was strength in the quarterly movement in the fourth quarter, margins still remained lower than pre-pandemic levels in the subsector. Building material and supplies (-3.4%) and personal and household goods (-0.2%) merchant wholesalers also reported year-over-year declines in the fourth quarter.

Year-end review: 2020

In 2020, the COVID-19 pandemic and subsequent lockdown measures created uncertainty for merchant wholesaler business operations. Many businesses saw their margins post large quarterly and year-over-year movements.

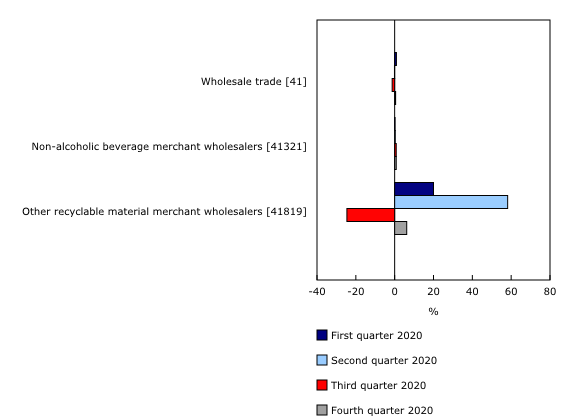

Quarterly margin volatility

The year 2020 saw wholesale sector margins post quarterly movements, from a decrease of 1.3% to a gain of 0.9%.

The industry with the most volatile quarterly margin movements was the other recyclable material merchant wholesalers, whose margins rose 58.2% in the second quarter but fell 24.6% in the third quarter. Merchant wholesalers in live animal, and petroleum and petroleum product industries also recorded volatile quarterly movements.

By contrast, non-alcoholic beverage merchant wholesalers saw the smallest quarterly variability. Margin movements in the industry ranged from a smaller 0.2% gain in the first quarter to a 0.8% increase in the third quarter. Other specialty-line building supplies, and toiletries, cosmetics and sundries merchant wholesalers also saw little quarterly variation in their margins during the pandemic.

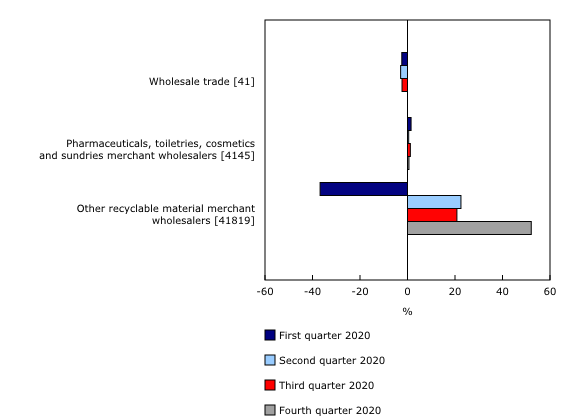

Year-over-year margin volatility

Margins were stable for the wholesale sector compared with 2019.

Other recyclable material merchant wholesalers reported the largest year-over-year margin changes in 2020, ranging from a 36.8% decline in the first quarter to a 52.1% increase in the fourth quarter. Live animal, and computer, computer peripheral and pre-packaged software merchant wholesalers also reported marked year-over-year margin volatility.

Pharmaceuticals, toiletries, cosmetics and sundries merchant wholesalers reported the smallest year-over-year margin movements in 2020, ranging from a 1.5% increase in the first quarter to a 0.5% gain in the second quarter. Pharmaceuticals and pharmacy supplies, and jewellery and watch merchant wholesalers also reported small year-over-year movements.

Note to readers

The Wholesale Services Price Index (WSPI) represents the change in the price of wholesale services. The price of a wholesale service is defined as the margin price, which is the difference between the average purchase price and the average selling price of the wholesale product being priced. The WSPI is not a wholesale selling price index.

With each release, data for the previous quarter may have been revised. The series are also subject to an annual revision with the release of second-quarter data of the following reference year. The indexes are not seasonally adjusted. Data are available at the Canada level only.

Products

An overview of the impact of COVID-19 on the beef supply chain, as well as a comparison of the WSPI's first- and second-quarter results against previous forecasts, was presented in the Statistics Canada webinar, "COVID-19's Impacts on the Wholesale Trade Sector: What does the survey data tell us about sales, prices and the recovery so far?" held on December 17, 2020. Please contact infostats@statcan.gc.ca for presentation material.

The study, "COVID-19 and the beef supply chain: An overview," part of the series, StatCan COVID-19: Data to Insights for a Better Canada (45280001), is also available.

For details on the impact of COVID-19 previously forecasted for the wholesale sector, please consult the publication, "COVID-19 Impact Analysis and 2020 Outlook: Wholesale Services Price Index." This is part of a series of analyses on the impacts of COVID-19 on different sectors of the Canadian economy, which aims to provide data users with some insight regarding the price movements of selected industries.

Statistics Canada has released the Wholesale and Retail Services Price Indexes: Interactive Tool. This web-based application provides access to wholesale and retail margin data by category.

Statistics Canada has also launched the Producer Price Indexes Portal as part of a suite of portals for prices and price indexes. This web page provides Canadians with a single point of access to a wide variety of statistics and measures related to producer prices.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: