Pension Satellite Account, 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-12-11

Pension wealth continues to increase

The pension wealth of Canadians grew 10.4% in nominal terms in 2019, increasing to $4,250 billion by the end of the year after slower growth in 2018 (+0.7%). This faster pace of growth was predominately due to gains in equity markets, which impacted the market value of assets. By the end of 2019 the Toronto Stock Exchange (TSX) and Standard & Poor's 500 (S&P 500) increased by 19.1% and 28.9%, respectively, a rebound from the end of 2018 when markets sharply declined.

Growth among all three pension tiers (social security, employer-based, and individual registered savings plans) contributed to the gains in overall pension wealth in 2019.

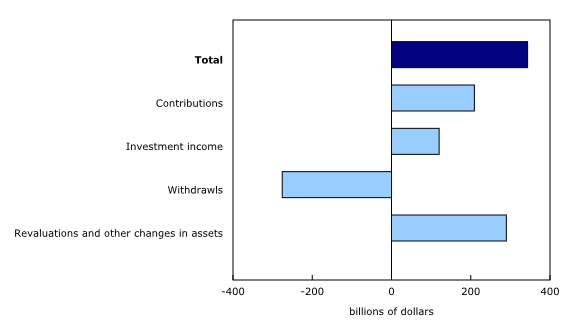

Revaluations (the change in wealth due to changes in asset prices) and other volume changes contributed $290 billion to the increase in pension wealth in 2019, a reversal from the $81 billion downward revaluations in the previous year when the S&P 500 and TSX posted significant declines at the end of 2018.

Pension contributions reached $209 billion in 2019, while investment income grew 2.1% and withdrawals posted an increase of 5.5%. Pension plan withdrawals excluding Old Age Security have continued to exceed total amount of contributions since 2015. For individual registered retirement saving plans, withdrawals have continued to exceed contributions since 2014. According to estimates based on the latest census, Canada has an aging population, with 17.5% of Canadians being over the age of 65 as of 2019, up from 12.6% in 2000. This may result in increased withdrawals over time as individuals enter retirement and draw upon their pension savings. However, contribution rates can be adjusted to ensure that plans remain actuarially sound.

Impact of COVID-19 on pension wealth

As part of the National Balance Sheet Accounts, quarterly information is available for both trusteed pension plans and social security, referred to as financial sectors, including assets, liabilities, and net worth. The combined pension assets held in these two sectors accounted for 59.1% of total pension wealth at the end of 2019.

Throughout 2020, the pension wealth of Canadian households as measured by these financial sectors weathered volatile financial markets and a fragile economy as unprecedented levels of government stimulus entered the financial system in many countries. In response to the onset of COVID-19 in early 2020, the markets exhibited a flight-to-safety. Equity markets declined sharply, with the TSX losing 21.6% of value and the S&P 500 falling 20.0% by the end of the first quarter.

However, the markets rebounded and by the end of the third quarter the S&P 500 was up 4.1% since the fourth quarter of 2019. Furthermore, the index briefly hit all-time highs in August 2020, five months after the March bottom. The TSX also recovered, but at a slower pace. By late November, the TSX had regained its losses on the year, but had yet to reclaim all-time highs. While trusteed pension plans and social security had all posted declines in the value of their equity holdings in the first quarter of 2020, by the end of the third quarter these losses had been erased.

There is still a large amount of uncertainty regarding the ongoing impact of the pandemic on financial markets and economic growth, especially as some economies enter a second wave of infections. Overall, the events since March 2020 have created a challenging investment environment. Both trusteed pension plans and social security invest in a wide variety of assets and this diversification may have helped Canadian pension plans weather the storm.

Pension wealth is an important component of household net worth; it consistently accounts for over half of household's total financial assets and represents over one-third of overall household wealth.

The value of household non-financial assets, which are also an important contributor to net worth and which may serve as an alternate source of retirement income for some individuals, increased 3.7% in 2019, compared with a decline of 0.8% in the preceding year. This growth, mainly fueled by a rebound in real estate values following declining property prices in 2018, outpaced the rise in pension wealth.

Wealth of social securities outpaces other pension tiers

All three pension tiers benefited from the strong performance in the stock markets, with each of them posting large gains in revaluation and other changes in assets for 2019.

By the end of 2019, the wealth of social security plans rose 13.5%. Social security plans benefited from upward revaluations that were more than twice the gain than in the prior year. Both the Canada Pension Plan (+14.1%) and the Quebec Pension Plan (+10.2%) increased their wealth.

The value of employer-based pension plans rose 9.3% by the end of 2019, outpacing the previous year's milder 1.3% increase. The value of trusteed pension plans, which account for the majority of employer-based pension plans, increased by 10.4% after edging down in 2018. As shown in the National Balance Sheet Accounts, this sector's growth was mainly due to higher market value of foreign equity and listed shares.

The value of individual registered saving plans increased 11.3% by the end of 2019. The majority of this increase was due to upward revaluations and other changes. Investment income grew 6.2% in 2019.

Note to readers

The Pension Satellite Account (PSA) provides an integrated stock-flow representation of the Canadian pension system. The PSA fully articulates the wealth positions (level of assets) as well as the pension inflows (contributions, investment income), outflows (withdrawals), and revaluations (unrealized gains and losses) and other volume changes in assets that contribute to the change in wealth. The period-to-period change in pension wealth can be decomposed into each of the components above with positive inflows increasing wealth, outflows decreasing wealth, and revaluations having an effect depending on whether prevailing asset prices are increasing (increase to wealth) or decreasing (decrease to wealth) by instrument. Other volume changes represents changes in wealth not due to transactions (inflows and outflows) or price effects and include items such as the writing off of a loan asset.

The PSA presents annual estimates for each of the three tiers of the Canadian pension system: social security, employer-based pension plans, and voluntary individual registered savings plans. The institutional dimension of the PSA presentation has been mainly defined by data availability. The breakdown of the three tiers into further detail is provided where data supported it and reflects a mixture of detail by program and by institutional dimension.

Some estimates on this page come from the National Balance Sheet Accounts.

For this release of the PSA, the data for the 1990 to 2018 period were revised.

Products

The data visualization product "Pension satellite account: Interactive tool," which is part of Statistics Canada – Data Visualization Products (71-607-X), is now available.

The Economic accounts statistics portal, accessible from the Subjects module of our website, features an up-to-date portrait of national and provincial economies and their structure.

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

An overview of the scope and structure of the Pension Satellite Account and a description of the sources and methods used to derive its stock and flow estimates are available in the Guide to the Canadian Pension Satellite Account (13-599-X).

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: