Canada's balance of international payments, third quarter 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-11-30

-$7.5 billion

Third quarter 2020

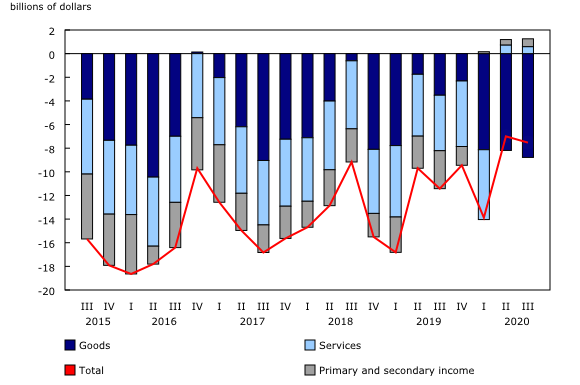

Canada's current account deficit (on a seasonally adjusted basis) expanded by $0.5 billion in the third quarter to $7.5 billion. A larger deficit in trade in goods and services was moderated by a higher investment income surplus in the quarter.

Overall, both exports and imports of goods increased significantly in the third quarter but were still below pre-pandemic levels. International travel services remained considerably low as travel restrictions continued to be in force. In comparison, commercial services have remained relatively strong since the start of the pandemic in part due to the nature of this activity. Commercial services are more likely to be provided remotely than other types of services such as travel and transportation services.

In the financial account (unadjusted for seasonal variation), inflows of funds to finance the current account deficit largely came from the repatriation of funds held abroad in the form of loans and deposits.

Foreign investment in Canadian debt securities slowed substantially compared with the record high of the second quarter, as borrowing needs of governments to support Canadian enterprises and households affected by the pandemic declined.

Portfolio and direct investment activity both generated a net outflow of funds from the economy in the third quarter. For these two types of investment, there were more acquisitions of foreign assets by Canadian investors than acquisitions of Canadian assets by foreign investors in the quarter. Meanwhile, cross-border mergers and acquisitions slowed to very low levels.

Current account

Exports and imports of goods rebound

The combined trade in goods and services deficit expanded by $0.7 billion to $8.2 billion in the third quarter. The goods and services balances both deteriorated in the quarter.

The trade in goods deficit was up by $0.6 billion to $8.8 billion. Both exports and imports rebounded after the large reductions recorded in the second quarter. Goods imports were up by a record $30.0 billion to $144.9 billion in the third quarter, with motor vehicles and parts accounting for more than half of this increase through higher volumes. Imports of consumer goods were up $3.8 billion on higher volumes.

Goods exports increased by $29.4 billion to $136.1 billion. The largest gains were in motor vehicles and parts, up $14.4 billion on higher volumes, as well as energy products, up $6.7 billion on higher prices (+58%). These two categories of products also recorded the largest reductions in the second quarter.

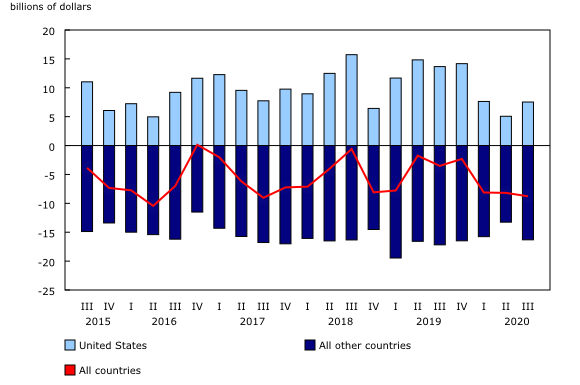

On a geographical basis, the trade surplus with the United States was up $2.5 billion, while the trade deficit with non-US countries expanded by $3.1 billion. The trade deficit with Mexico increased by $1.6 billion on higher imports of automotive products.

Trade in services surplus down slightly

The trade in services surplus edged down by $0.1 billion to $0.6 billion in the third quarter. The travel balance, in an atypical surplus position since the second quarter due to the dampening activity in the tourism sector, posted a reduction of $0.9 billion of its surplus. Lower enrollments of international students in the Canadian education sector, translating into lower receipts of education-related travel, accounted for most of this reduction.

The commercial services balance posted a surplus of $0.8 billion in the third quarter from a balanced position in the second quarter. Exports of commercial services were up $0.4 billion, while imports were down $0.5 billion. A large decrease, from a record level in the previous quarter, in commissions paid on new issues of Canadian bonds on foreign financial markets mainly contributed to the overall reduction in imports.

The investment income surplus increases

The primary income surplus, which includes compensation of employees and investment income, increased by $0.4 billion to $1.7 billion in the third quarter. Most of this change was the result of a higher investment income surplus.

Canada's investment income surplus increased by $0.4 billion to $2.6 billion. Profits earned by Canadian investors on their direct investment abroad were up by $1.6 billion. This was moderated by lower interests earned by Canadian banks on their activities abroad. On the payments side, profits earned by foreign direct investors on their assets in Canada were up by $0.9 billion.

Financial account

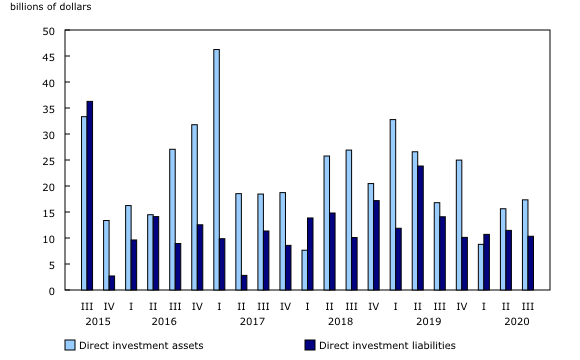

Cross-border mergers and acquisitions activity slows to low levels

Canadian direct investment abroad amounted to $17.3 billion in the third quarter, up from $15.6 billion in the second quarter but well below the levels recorded in 2019. Mergers and acquisitions activity totalled $2.3 billion, the lowest level since the first quarter of 2013. In terms of destination of the investment, the majority was directed to the United States, while in terms of industry, the finance and insurance sector accounted for almost half of the activity.

Foreign direct investment in Canada was $10.3 billion in the third quarter, a level comparable to each of the previous three quarters. Mergers and acquisitions activity slowed to $1.6 billion, down from $8.9 billion in the second quarter and the lowest level in six quarters.

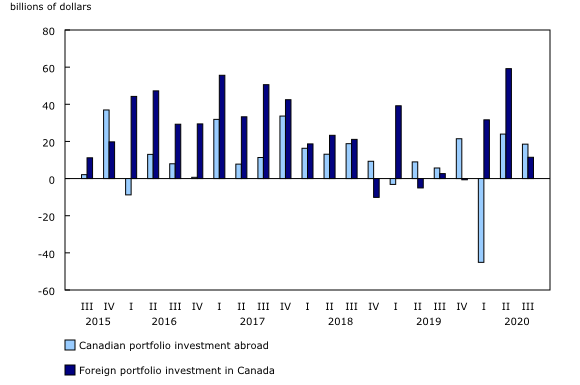

Canadian investment in foreign securities continues

Canadian investors acquired $18.5 billion of foreign securities in the third quarter, a second consecutive quarter of acquisitions following a record divestment of $45.1 billion in the first quarter.

Canadian investors increased their holdings of foreign shares by $11.9 billion in the quarter, mainly shares issued by large US capitalization firms of the technology sector. Over the third quarter, the US stock market grew by 8.5%.

At the same time, Canadian investors resumed their acquisitions of foreign bonds, adding $8.4 billion to their holdings, following a divestment of $14.9 billion in the first half of the year. Purchases of non-US foreign bonds were the main contributor to the activity.

Foreign investment in Canadian securities slows significantly

Foreign investors increased their holdings of Canadian securities by $11.5 billion in the third quarter. They increased their exposure to equities and money market instruments, but reduced their holdings of Canadian bonds. This followed a $59.2 billion investment in the second quarter.

Foreign investors reduced their holdings of Canadian bonds by $3.2 billion in the third quarter. This followed significant investments totalling $119.5 billion in the first half of the year, in the wake of increased borrowing needs from governments to support Canadians affected by the pandemic. Meanwhile, foreign investors acquired $8.0 billion of Canadian money market instruments, mainly federal government paper.

Following three consecutive quarters of divestment, non-resident investors resumed their purchases of Canadian shares in the third quarter and injected $6.6 billion of funds in the Canadian equity market. Investors acquired shares mainly from the mining and energy sector.

Note to readers

As some data sources were received with delays and response rates to our quarterly surveys are generally lower due to current conditions, higher revisions in the data may be recorded.

Because of the unusually small values in travel services since the beginning of the second quarter of 2020, future revisions to seasonally adjusted data for the months of 2020 can be expected to be larger than usual. With uncertainty about how long the impacts of COVID-19 on world tourism activities will continue, the unadjusted (raw) travel data may provide more useful information for users on the short-term changes in international travel services data.

Revisions

This release incorporates statistical revisions back to the first quarter 2017 as part of the annual revision exercise of the Canadian System of Macroeconomic Accounts. Revisions reflect the integration of new data sources as well as improved methodologies.

Definitions

The balance of international payments covers all economic transactions between Canadian residents and non-residents in three accounts: the current account, the capital account and the financial account.

The current account covers transactions in goods, services, compensation of employees, investment income and secondary income (current transfers).

The current account data in this release are seasonally adjusted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

The capital account covers capital transfers and transactions in non-produced, non-financial assets.

The financial account covers transactions in financial assets and liabilities.

In principle, a net lending (+) / net borrowing (-) derived from the sum of the current and capital accounts corresponds to a net lending (+) / net borrowing (-) derived from the financial account. In practice, as data are compiled from multiple sources, this is rarely the case and gives rise to measurement error. The discrepancy (net errors and omissions) is the unobserved net inflow or outflow.

Foreign direct investment is presented on an asset-liability principle basis (that is, gross basis) in the financial account. Foreign direct investment can also be presented on a directional principle basis (that is, net basis), as shown in supplementary foreign direct investment tables 36-10-0025-01, 36-10-0026-01, and 36-10-0473-01. The difference between the two foreign direct investment conceptual presentations resides in the classification of reverse investment such as (1) Canadian affiliates' claims on foreign parents and (2) Canadian parents' liabilities to foreign affiliates. Under the asset/liability presentation, (1) is classified as an asset and included in direct investment assets, also referred to as direct investment abroad in this text, and (2) is classified as a liability and included in direct investment liability, also referred to as direct investment in Canada in this text.

For more information on the balance of payments, consult chapter 8, "International accounts," in the User Guide: Canadian System of Macroeconomic Accounts, available on our website. The chapter also presents the most recent balance of payments statistics.

Real-time table

Real-time table 36-10-0042-01 will be updated on December 7. For more information, see Real-time tables.

Next release

Balance of international payments data for the fourth quarter of 2020 will be released on March 1, 2021.

Products

The product Methodology for Exports of Energy Products within the International Merchandise Trade Program, which is part of Latest Developments in the Canadian Economic Accounts (13-605-X), is now available.

The product Canada and the World Statistics Hub (13-609-X) is available online. This product illustrates the nature and extent of Canada's economic and financial relationship with the world using interactive graphs and tables. This product provides easy access to information on trade, investment, employment and travel between Canada and a number of countries, including the United States, the United Kingdom, Mexico, China and Japan.

The Economic accounts statistics portal, accessible from the Subjects module of our website, features an up-to-date portrait of national and provincial economies and their structure.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

To enquire about the concepts, methods or data quality of this release, contact Denis Caron (denis.caron@canada.ca), International Accounts and Trade Division.

- Date modified: