New Housing Price Index, October 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-11-20

October 2020

0.8%

(monthly change)

October 2020

2.0%

(monthly change)

October 2020

0.0%

(monthly change)

October 2020

1.2%

(monthly change)

October 2020

0.0%

(monthly change)

October 2020

2.2%

(monthly change)

October 2020

0.6%

(monthly change)

October 2020

0.1%

(monthly change)

October 2020

0.5%

(monthly change)

October 2020

0.3%

(monthly change)

October 2020

1.2%

(monthly change)

New house prices continued to increase in the majority of housing markets across the country in October.

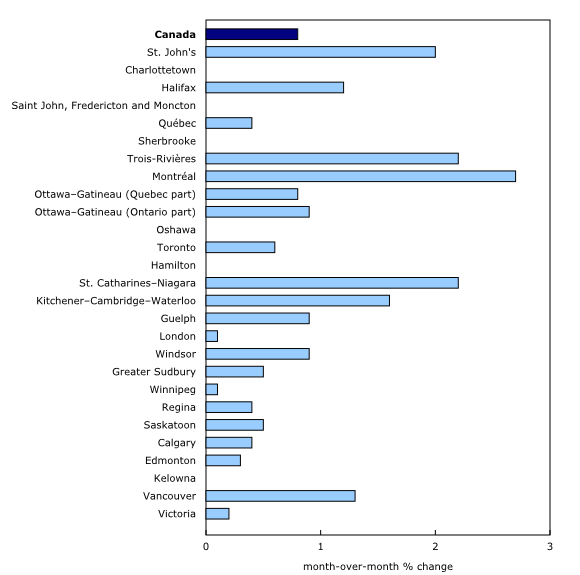

Nationally, prices for new homes rose 0.8% in October following a 1.2% acceleration in September, with prices up in 21 of the 27 census metropolitan areas surveyed.

The global pandemic has affected the housing markets in many ways. For example, borrowing rates have fallen to historic lows and buyer demand has shifted towards larger homes. There has also been increased demand for homes in cities surrounding larger urban centres such as Toronto, Vancouver and Montréal. All of these factors have contributed to higher new home prices across Canada.

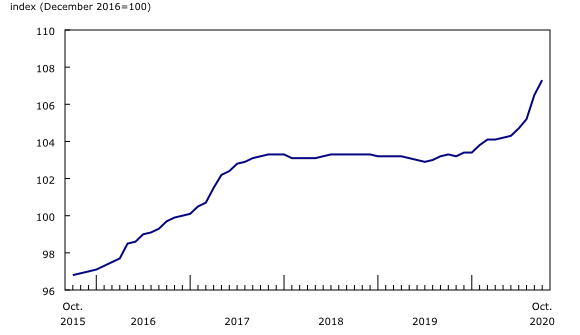

New home prices have risen 3.1% nationally since the beginning of the pandemic in March. In comparison, new home prices edged up 0.1% from March to October last year.

Historically low mortgage rates increase demand for new homes

The Bank of Canada lowered its policy interest rate from 1.75% in January to 0.25% in late March to ease the impact of COVID-19 on the overall economy. This decrease led to historically low borrowing rates available to home buyers, which have contributed to the increased demand for homes since the global pandemic began. The latest housing affordability index also shows that affordability is improving—despite rising new home prices.

Nationally, the new housing market remained strong. Fewer (-20.5%) completed new single family (single, semi-detached and row) homes were available for sale in October compared with the same month in 2019, as reported by the Canada Mortgage and Housing Corporation.

New Housing Price Index, monthly change

New house prices rose at the fastest pace in Montréal (+2.7%) in October, followed by St. Catharines–Niagara and Trois-Rivières (both up 2.2%). Builders attributed the increase in all three cities to higher construction costs and strong market conditions.

New house prices also continued to rise in Canada's most expensive markets of Vancouver (+1.3%) and Toronto (+0.6%) in October.

Cities relying on the natural resource sector saw prices decline since the pandemic began, however, prices were up in both Calgary (+0.4%) and Edmonton (+0.3%) for a second consecutive month in October.

New Housing Price Index, 12-month change

Nationally, new house prices increased 3.9% year over year in October—the largest yearly increase since June 2017.

New house prices continued to rise in Ottawa (+13.0%), increasing at their fastest pace year over year in nearly two decades (June 2001). Montréal (+8.7%) posted its largest year-over-year gain in October since February 2003.

In Southern Ontario, new house prices continued to grow in Kitchener–Cambridge–Waterloo (+6.7%), Guelph (+6.2%), St. Catharines–Niagara (+6.0%) and Hamilton (+5.9%). Many homebuyers now deem these cities to be more appealing to live in, due to their relative affordability compared with Toronto. Additionally, with teleworking arrangements possible, these cities have now become a viable option for homebuyers able to work from home.

Outlook for the new housing market to remain strong in the near term

The Bank of Canada recently committed to maintaining the overnight rate at 0.25% until inflation reaches the targeted 2.0% rate. The inflation rate in October was up 0.7% as reported by the Consumer Price Index. The Bank's current projection for achieving a 2.0% inflation rate indicates that this will most likely not occur until 2023, hence borrowing costs could remain at historically low levels. We anticipate that low borrowing rates, coupled with increased demand for single family homes from homebuyers seeking more living space, will continue to apply upward pressure on new home prices in the near term.

Note to readers

The New Housing Price Index (NHPI) measures changes over time in the selling prices of new residential houses. The prices are those agreed upon between the contractor and the buyer at the time of the signing of the contract. The detailed specifications pertaining to each new house remain the same between two consecutive periods.

The prices collected from builders and included in the index are market selling prices less value-added taxes, such as the federal Goods and Services Tax or the provincial harmonized sales tax.

The survey covers the following dwelling types: singles, semi-detached and townhouses or row homes. The index is available at the national and provincial levels, and for 27 census metropolitan areas (CMAs).

The index is not subject to revision and is not seasonally adjusted.

In addition to this monthly release, the NHPI has also been integrated into the Residential Property Price Index (RPPI). The RPPI is a quarterly series that measures changes over time in the prices of residential properties for Montréal, Ottawa, Toronto, Calgary, Vancouver and Victoria. An aggregate for these six CMAs is also available. The RPPI provides a price index for all components of the housing real estate market—new and resale—in addition to a breakdown between houses and condominium apartments.

Products

The article "The resilience and strength of the new housing market during the pandemic" examines the changes in new home prices in Canada for the 27 surveyed CMAs captured in the NHPI and compares the ranking of cities based on prices six months into the pandemic (August compared with February).

A study on "Price trends and outlook in key Canadian housing markets" looks at where the housing market was at the onset of the COVID-19 pandemic, sheds light on what has happened since then, and explores the challenges of the Canadian market going forward.

The infographic "The impact of COVID-19 on Key Housing Markets," part of the series Statistics Canada – Infographics (11-627-M), is available. It provides an outlook of the housing market before, during and after COVID-19.

The "New Housing Price Index: Interactive Dashboard," which allows users to visualize statistics on new housing prices, is available.

The "Housing Market Indicators" dashboard, which provides access to key housing market indicators for Canada, by province and by CMA, is also available.

For more information on the topic of housing, visit the housing statistics portal.

The video "Producer Price Indexes" is available on the Statistics Canada Training Institute webpage. It provides an introduction to Statistics Canada's Producer Price Indexes: what they are, how they are compiled and what they are used for.

Statistics Canada has launched the Producer price indexes portal as part of a suite of portals for prices and price indexes. This web page provides users with a single point of access to a wide variety of statistics and measures related to producer prices.

Next release

The New Housing Price Index for November will be released on December 18.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: