Provincial and territorial economic accounts, 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-11-09

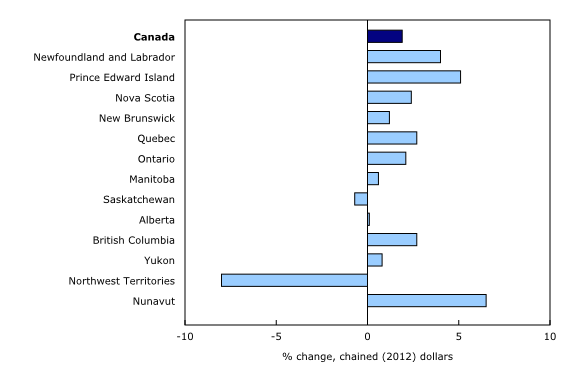

Real gross domestic product (GDP) rose in all provinces and territories except Saskatchewan and the Northwest Territories. Nationally, growth in real GDP slowed from 2.4% in 2018 to 1.9% in 2019—reflecting slower growth in most regions. This growth in real GDP was attributable to higher household spending on semi-durable goods (+2.3%) and services (+2.1%), coupled with growth in exports (+1.3%) which exceeded that in imports (+0.4%) in 2019.

Canada's economic growth was dampened by a number of factors. Business investments in intellectual property products fell 1.9% and housing investment edged down 0.2%, following a 1.7% decline in 2018. Business investment in non-residential structures slowed from 2.7% to 1.1% in 2019, and in machinery and equipment from 3.7% to 1.0%, which coincided with the slowdown in imports. General governments' investment slowed from 4.3% to 0.3% in 2019. Largely owing to a decline in purchases of new cars, household spending on durable goods remained flat.

Newfoundland and Labrador

Real GDP of Newfoundland and Labrador rebounded to reach 4.0%, after a 3.5% decline in 2018.

Growth in real GDP was driven by business investment in machinery and equipment (+9.8%) and in non-residential structures (+4.4%), resulting largely from construction of the West White Rose Project at the Hebron offshore oil platform. The increase was moderated by a 6.0% decline in housing investment, following a 5.0% drop in 2018. Exports rose 4.2%, largely driven by exports of oil and iron ore. Imports edged down 0.3%, after a 2.9% increase in 2018.

Prince Edward Island

Prince Edward Island's growth accelerated to 5.1%—the largest increase among the provinces—after rising 2.5% in 2018.

Growth was driven by a 21.4% increase in housing investment, which coincided with an influx of immigrants in recent years. In tandem with housing investment, household spending on durable goods (+4.1%) and services (+3.5%) rose. These increases were moderated by declines in business investment in machinery and equipment (-1.7%) and in intellectual property products (-1.8%). Exports rose 3.2% and imports increased 2.1%.

Nova Scotia

Nova Scotia's economy increased 2.4%, after rising 1.9% in 2018.

Growth was led by higher investment in residential structures (+10.8%), due to a strong population increase. Growth was dampened by a sharp downturn in business investment in intellectual property products (-37.1%), resulting mainly from lower oil and gas and mineral exploration activities—2019 marked the end of offshore oil and gas activity which began in 1999. Household spending rose 1.4%, with higher spending on both goods (+0.8%) and services (+1.9%). Growth in exports accelerated to 3.4%, and growth in imports slowed to 1.0% in 2019 from 2.9% in 2018.

New Brunswick

New Brunswick's real GDP rose 1.2%, after edging up 0.5% in 2018.

Growth was driven by housing investment (+4.5%) and a decline in imports (-2.5%). Business investment in non-residential structures (-11.1%) and in machinery and equipment (-12.1%) declined, as did general governments' investment (-17.2%), primarily because of reduced non-residential construction investment by the provincial government. Household spending rose 1.0%, with higher expenditures on both goods (+1.2%) and services (+0.8%). Exports declined 0.8%, partly because of a drop in mineral exports owing to a labour strike at Brunswick Smelter in Belledune.

Quebec

Quebec's economy grew 2.7%, after rising 2.9% in 2018.

Growth was led by business investments in machinery and equipment (+7.3%)—and in non-residential structures (+6.3%), boosted by structures in the manufacturing, transportation and warehousing industries. Housing investment rose 3.7%, after a 3.9% increase in 2018. Household spending rose 2.1%, with higher expenditures on both goods (+2.1%) and services (+2.1%). Exports increased 1.7%, and imports rose 1.9%.

Ontario

Ontario's economy increased 2.1%, after rising 2.8% in 2018.

Growth was driven by household spending on services (+2.3%)—stemming largely from higher spending on housing, water, electricity and gas and on insurance and financial services, and by exports of services to other countries (+2.2%) and to other provinces (+3.1%). These gains were partly offset by declines in business investment in non-residential structures (-4.3%) and in intellectual property products (-1.1%). Housing investment edged up 0.5%, after declining 3.6% in 2018. Because of a sharp decline in purchases of new passenger cars, growth in household spending on durable goods slowed from 3.8% to 0.2%.

Manitoba

Manitoba's real GDP growth slowed to 0.6%, following a 1.5% rise in 2018.

Growth was primarily driven by housing investment (+3.5%), household spending on services (+1.5%) and exports of services to other countries (+4.9%). These increases were moderated by a drop in business investment in non-residential structures (-2.1%) and declines in exports of goods to other countries (-2.9%) and other provinces (-5.7%). Total exports of goods and services fell 2.3%, and imports edged down 0.2%. Household spending on durable goods fell 0.7%, while spending on semi-durable goods (+1.9%) and non-durable goods (+0.9%) rose.

Saskatchewan

Saskatchewan's real GDP declined 0.7%, following a 1.2% rise in 2018.

Several factors contributed to the decline. Housing investment continued to decline (-11.7%), after falling 10.6% in 2018; business investment in intellectual property products fell 6.7%; and exports fell 2.4% owing to weaker international demand for potash and other metal ores. The declines were partly offset by higher household spending on goods (+1.3%); household spending on services edged up 0.5%. Imports dropped 1.6%, after edging up 0.2% in 2018.

Alberta

Alberta's economy slowed to 0.1% from a 1.9% rise in 2018.

The slowdown resulted from a sharp drop in housing investment (-8.4%), after falling 3.5% in 2018. Business investment in non-residential structures fell 9.0%, owing to declines in mining, quarrying and oil and gas extraction. Because of reduced exploration and development activities, business investment in intellectual property products fell 3.2%. Nonetheless, a 1.0% rise in exports and a 1.2% drop in imports, along with higher household spending on services (+1.2%), pushed growth into the positive territory.

British Columbia

Real GDP of British Columbia rose 2.7%, following the same pace of growth in 2018.

Growth was driven by a sharp rise (+35.3%) in business investment in non-residential structures, owing largely to the ramping up of natural gas projects, including the Coastal GasLink pipeline. Growth was dampened by a decline in housing investment (-1.4%); coinciding with this decline, household spending on durable goods fell 2.3%. Household spending on services rose 3.0%, after a similar increase in 2018. Exports rose 0.9% and imports increased 2.7%.

Yukon

Yukon's real GDP growth slowed to 0.8% from 3.8% in 2018.

This was a result of downturns in business investment in non-residential structures (-30.9%), and in machinery and equipment (-58.4%), largely due to closure of a major mining project in 2018. Exports fell 4.3%, and imports dropped 2.7%. Higher general governments' final consumption (+2.7%) and investment (+38.0%), coupled with higher household spending (+2.0%) and an accumulation of business investment in inventories amounting to $15.0 million, pushed growth into the positive territory.

Northwest Territories

Real GDP of the Northwest Territories fell 8.0%, the largest decline since 2011, after rising 0.8% in 2018.

Declines were widespread. Housing investment fell 14.1%, following a 5.3% drop in 2018. Because of a record drop in diamond mining, business investment in non-residential structures fell sharply (-50.6%). Exports declined 13.2%, after rising 2.7% in 2018. These declines were partly offset by increases in household spending on durable goods (+2.3%) and general governments' investment (+24.3%). Imports declined 2.8%, after edging down 0.4% in 2018.

Nunavut

Nunavut's real GDP grew 6.5%, after rising 5.2% in 2018.

This growth was driven by a rebound in housing investment (+37.8%), and increased exports (+13.8%) attributable to gold, silver and iron ore, coupled with a drop in imports (-1.9%). These increases were partly offset by declines in business investments in machinery and equipment (-31.1%) and in intellectual property products (-26.4%). Household spending rose 1.4%, with higher spending on goods (+1.6%) and services (+0.9%).

Impacts of COVID-19

Primarily owing to the COVID-19 pandemic, Canada's economic activities (household spending, business investment, trade) fell sharply in the first half of 2020—resulting in declines in real GDP of 2.1% in the first quarter, and 11.5% in the second quarter. Declines were particularly pronounced in tourism, transportation, and petroleum industries, signalling that the drop in real GDP would vary across regions, as would the expected rise in real GDP in the second half of the year.

The data in this release will constitute the baseline for comparisons with 2020 and for assessments of the impact of COVID-19 on provincial and territorial GDP.

Note to readers

This release incorporates revisions to the Provincial and Territorial Economic Accounts for 2017 and 2018, and estimates for 2019. Estimates of provincial-territorial gross domestic product by industry from 2017 to 2019 were also revised. Both incorporate the new 2017 benchmark provincial and territorial supply and use tables, as well as revised provincial-territorial source data for 2018 and 2019.

This release also incorporates T4 benchmark data for 2018 and preliminary estimates for 2019, and revised source data from surveys including the Retail Commodity Survey, the International Trade in Services Survey, and the Annual Capital and Repair Expenditures Survey for 2018.

Percentage changes for expenditure-based statistics (such as household final consumption expenditure, gross fixed capital formation, exports and imports) are calculated from volume measures that are adjusted for price variations. Percentage changes for income-based statistics (such as compensation of employees and net operating surplus of corporations) are calculated from nominal values; that is, they are not adjusted for price variations.

For more information on gross domestic product, see the video "What is Gross Domestic Product (GDP)?"

Products

Provincial and territorial gross domestic product by income and expenditure accounts

Provincial and territorial gross domestic product (GDP) by income and expenditure accounts includes estimates of income- and expenditure-based GDP, real GDP, contributions to percent change in real GDP, implicit price indexes, the current accounts for the household sector, the property income of households and other selected indicators for the household sector.

The data visualization product "Provincial and territorial economic accounts: Interactive tool," which is part of Statistics Canada—Data Visualization Products (71-607-X), is now available.

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Gross domestic product by industry – Provincial and territorial (annual)

Revised figures for 2017 to 2019 provincial and territorial gross domestic product (GDP) by industry are included with this release.

The data visualization product: "Gross domestic product (GDP) by industry, provinces and territories: Interactive tool" was also revised for the 2017 to 2019 period. This tool seeks to facilitate user interaction with GDP data as part of Statistics Canada's corporate vision to make data more accessible in useful ways.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: