Trade of culture and sport products, 2017

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2019-06-13

In 2017, Canada imported $25.2 billion and exported $17.5 billion of culture and sport products, which include goods and services. Even though the country imported more than it exported, the majority of culture and sport products in Canada were produced domestically ($118.8 billion in 2017). In comparison, during the same year, Canada imported $714.1 billion and exported $663.7 billion of goods and services.

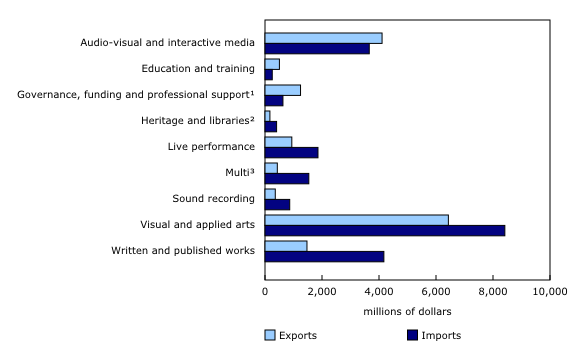

Visual and applied arts account for the largest share of culture product imports and exports

Canada exported $15.7 billion of culture products in 2017, down 7.6% from the previous year. This decrease was mainly attributable to declines in trade of craft products. Meanwhile, Canadians imported 3.1% more culture products in 2017, totalling $21.8 billion. Culture products accounted for 2.4% of all goods and services exports and 3.1% of total imports.

The largest contributor to both exports and imports of culture products in Canada was visual and applied arts, which includes crafts and design services. Additionally, audio-visual and interactive media, which includes film and video production and post-production services, was also a significant contributor to culture trade. This domain, along with education and training, and governance funding and professional support, were the only culture domains to record a trade surplus (more exports than imports) in 2017.

On the import side, written and published works and live performance, which includes Canadian travellers attending live performances in other countries, were notable contributors in 2017.

The United States has remained Canada's largest trading partner for culture products, representing over 60% of both culture exports and imports. Despite this dominant trading relationship, the share of culture trade with the United States has declined since 2010. Other notable trading partners include the European Union and China, which account for over 11% and 4% of culture trade respectively. Culture trade with China has trended upward since 2010.

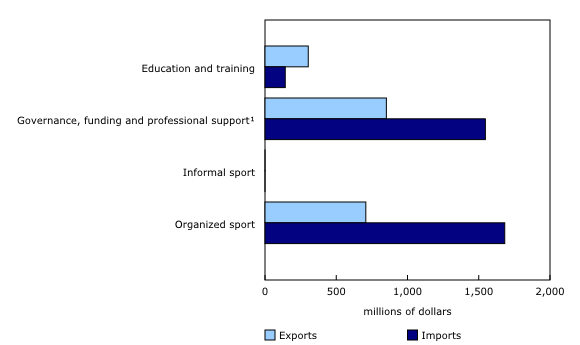

Imports of sports products nearly double those of exports

Canada exported $1.9 billion of sports products and imported $3.4 billion in 2017. Sport products accounted for 0.3% of all Canadian exports, and 0.5% of all goods and services imports.

Organized sport was one of the largest contributors to trade of sport products in 2017. Trade of organized sport includes Canadian travellers attending live sporting events in other countries (imports of sport products) and international travellers buying tickets for events in Canada (exports of sport products).

Governance, funding and professional support was also a top contributor to trade of sport products in 2017. This includes the fees for using government-run recreation and sport facilities, such as pools and arenas.

Roughly half of all sport exports and imports in 2017 were with the United States.

Broadcasting is top contributor to interprovincial trade in 2015

In 2015, interprovincial and territorial trade amounted to $16.9 billion of culture products, with broadcasting, film and video and interactive media the largest contributors. Culture products amounted to 4.6% of total interprovincial trade.

Interprovincial trade for sport products totalled $1.5 billion or 0.4% of total interprovincial trade in 2015. Governance, funding and professional support (which includes public sport facilities rentals) and organized sport led total interprovincial trade of sport products.

Ontario and British Columbia were the only provinces that exported more culture and sport products to other countries than within Canada. All the other provinces and territories had larger interprovincial than international exports of culture and sport products in 2015. In terms of imports, four provinces (Quebec, Ontario, Manitoba and British Columbia) imported more culture and sport from around the world than from other provinces and territories.

Note to readers

The Trade of Culture and Sport Products (TCSP) provides measures of the international and interprovincial trade of goods and services attributed to both culture and sport (inclusive of the arts and heritage).

These data were developed as an extension of the Canadian Culture Satellite Account and the Provincial and Territorial Culture Satellite Indicators by providing additional information regarding the state of culture and sport for Canada, the provinces and territories.

The TCSP are a joint initiative of Statistics Canada, other federal agencies, all provincial and territorial governments, as well as non-governmental organizations.

All estimates of international trade are recorded or converted after collection to Canadian dollars using daily or monthly average exchange rates.

Due to data availability, interprovincial trade can only be derived up until 2015.

Culture products are goods and services produced from creative artistic activities or from the preservation of heritage.

Sport products include goods and services related to recreational sports and physical activities, as well as professional, semi-professional or amateur sport clubs and independent athletes that are primarily engaged in presenting sporting events before an audience. Excluded are goods and services that serve as inputs for producing sport products such as equipment, whereas it includes merchandise sold at sporting events.

Crafts

The crafts sub-domain includes various manufactured products that originate from creative artistic activities. It includes items such as jewelry, pottery, and knives. However, due to measurement limitations estimates of trade for the crafts sub-domain may be overstated.

Film and video

The film and video sub-domain has undergone major enhancements starting with reference year 2015. The sources and methods for estimating this sub-domain, including the film, television and video production industry survey, have been revised to include improved estimation methods. The new methodology increases the use of administrative data in combination with survey data to build the estimates. These improvements to the methodology were applied to all economic variables, including trade.

As a result, the estimates for the film and video sub-domain for 2015 forward should not be compared with historical estimates as the new methodology represents a break in this time series.

Moreover, users should use with caution any aggregate estimates that include the film and video sub-domain such as the estimates of the audio-visual and interactive media domain and the total aggregate for culture. These aggregates will also be reflective of these improvements to the methodology and, depending on the economic importance of the film and video sub-domain, could be significantly impacted by the refinements.

Digital culture products

Traditional methods of delivery and consumption of services have been made more efficient in recent years with the use of technology. However, this has created challenges in measuring international trade of digital services. This includes digital culture products, such as online streaming services, subscriptions, and downloads that are purchased by Canadian households directly from foreign suppliers.

Products

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: