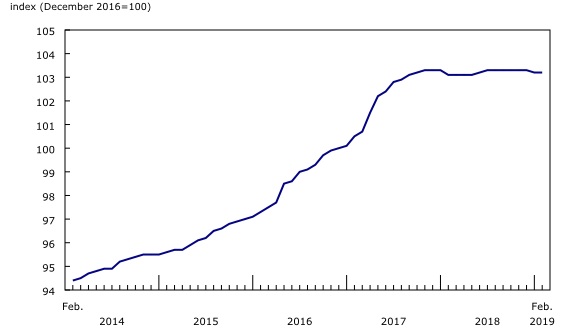

New Housing Price Index, February 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2019-04-11

February 2019

0.0%

(monthly change)

February 2019

0.0%

(monthly change)

February 2019

0.0%

(monthly change)

February 2019

0.2%

(monthly change)

February 2019

0.0%

(monthly change)

February 2019

0.0%

(monthly change)

February 2019

0.0%

(monthly change)

February 2019

0.0%

(monthly change)

February 2019

0.0%

(monthly change)

February 2019

-0.1%

(monthly change)

February 2019

-0.2%

(monthly change)

New house prices at the national level were unchanged in February, despite growth in some of the housing markets surveyed.

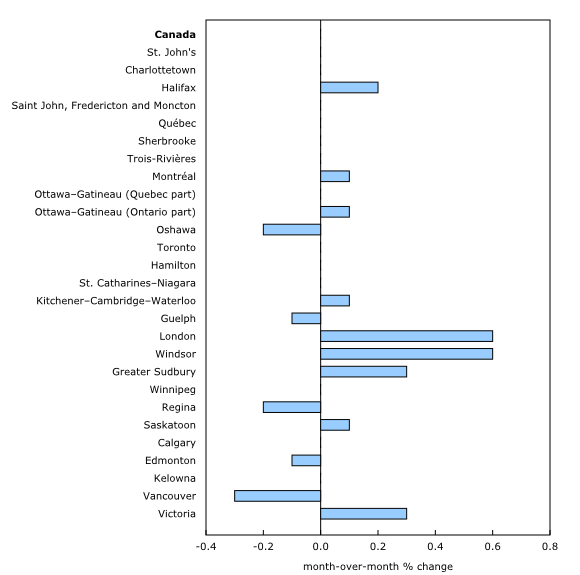

New Housing Price Index, monthly change

In February, builders in 9 of the 27 census metropolitan areas (CMAs) surveyed reported higher prices for homes they sold. London and Windsor (both up 0.6%) registered the largest increases as builders in both CMAs tied the gains primarily to higher construction costs.

Prices continue to rise in London

New home prices have been up almost every month in London since November 2017. Builders have largely linked the increases to strong market conditions.

Higher prices for new homes in London reflected increased demand as well as a strong resale market. This coincided with annual employment growth of 2.2% and a 1.9% population increase in February. According to the Canadian Real Estate Association, London's sales to new listings ratio was 69.4 in February. A ratio above 60 indicates a seller's market.

Declines in Canada's largest new housing markets

Four of Canada's largest new housing markets experienced slowing demand, as builders reported flat prices in Toronto and Calgary, and declining prices in Vancouver (-0.3%) and Edmonton (-0.1%) in February.

New house prices have decreased for four months in a row in Vancouver as builders linked the decline, in large part, to unfavourable market conditions. The pace of new construction has also slowed in this CMA. According to the Canada Mortgage and Housing Corporation, single-family housing starts declined 20.7% over the 12 months ending in February compared with the same period in 2018. Single-family homes include single, semi-detached and row houses.

New Housing Price Index, 12-month change

New house prices at the national level edged up 0.1% year over year in February.

For the ninth month in a row, home prices in the historically more affordable CMAs of Ottawa (+4.9%) and London (+3.4%) rose faster than in other CMAs surveyed.

Regina recorded the largest decrease (-2.8%) among the 11 CMAs that reported 12-month declines. New home prices in Regina have been decreasing steadily for the past year.

In February, annual price movements also declined in Toronto (-1.0%), Calgary (-0.8%), Vancouver (-0.6%) and Edmonton (-0.4%). These four CMAs combined represent 60% of the weight of the national index.

Note to readers

The New Housing Price Index measures changes over time in the selling prices of new residential houses agreed upon between the contractor and the buyer at the time of the signing of the contract. It is designed to measure the changes in the selling prices of new houses where detailed specifications pertaining to each house remain the same between two consecutive periods.

The survey covers the following dwelling types: singles, semi-detached and townhouses or row homes. The current value of the structure is independently indexed and is presented as the house series. The survey also collects contractors' estimates of the current value (evaluated at market price) of the land. These estimates are independently indexed to provide the published series for land. The index is available at the Canada and provincial levels, and for 27 census metropolitan areas.

The prices collected from builders and included in the index are market selling prices less value-added taxes, such as the federal Goods and Services Tax or the provincial harmonized sales tax.

The index is not subject to revision and is not seasonally adjusted.

Products

Statistics Canada has a new Housing Market Indicators Dashboard. This web application provides access to key housing market indicators for Canada, by province and by census metropolitan area. These indicators are automatically updated with new information from monthly releases, giving users access to the latest data.

A data table highlighting changes in new home prices in Canada and select census metropolitan areas is available as part of the Just the Facts series.

Next release

The New Housing Price Index for March will be released on May 9.

Products

The dashboard "Housing Market Indicators" is now available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: