Investment in building construction, January 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2019-03-21

$14.8 billion

January 2019

6.7%

(monthly change)

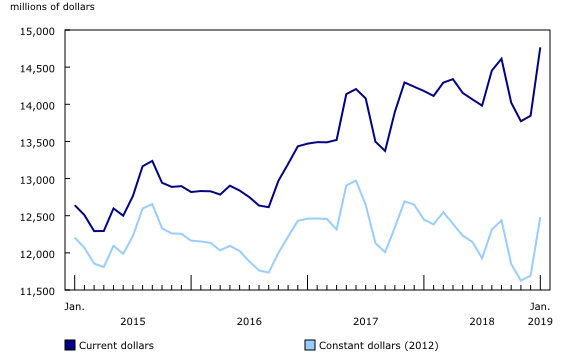

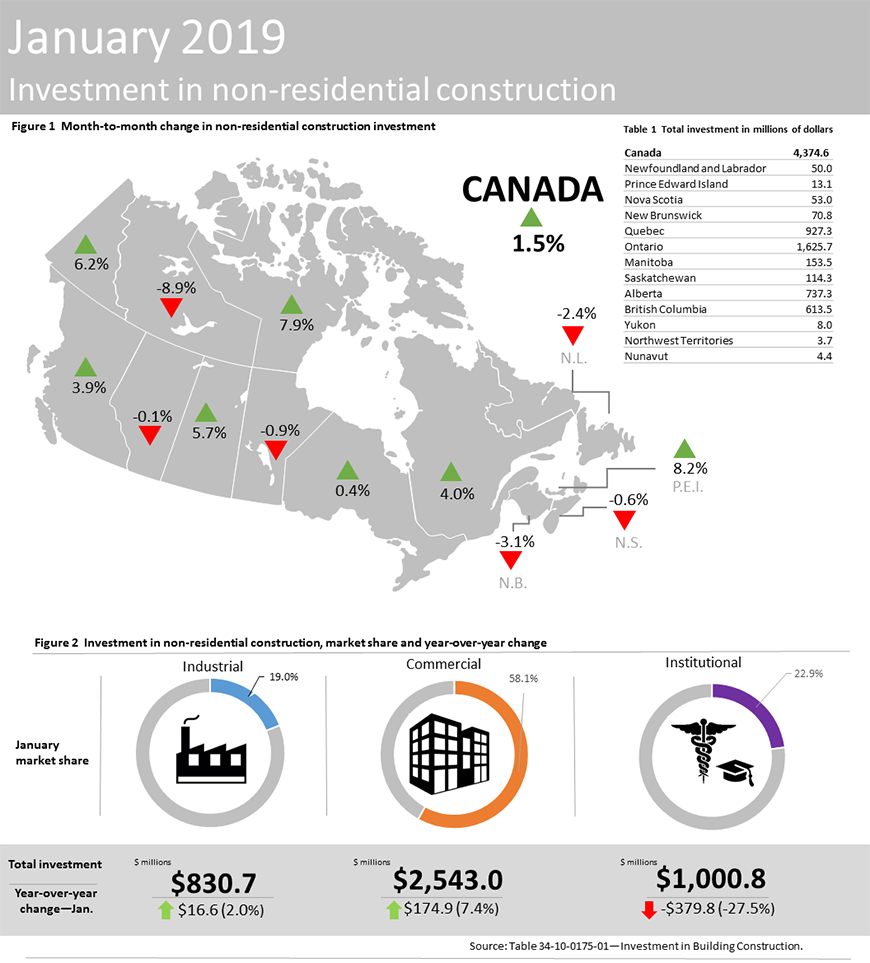

Total investment in building construction rebounded in January, up 6.7% from December to $14.8 billion. Gains in the residential sector (+9.0% to $10.4 billion) led investment for the month, as the non-residential sector continued to moderate the overall rate of investment in building construction (+1.5% to $4.4 billion). On a constant dollar basis (2012=100), investment in building construction also rose 6.7% to $12.5 billion. .

Investment in residential building construction

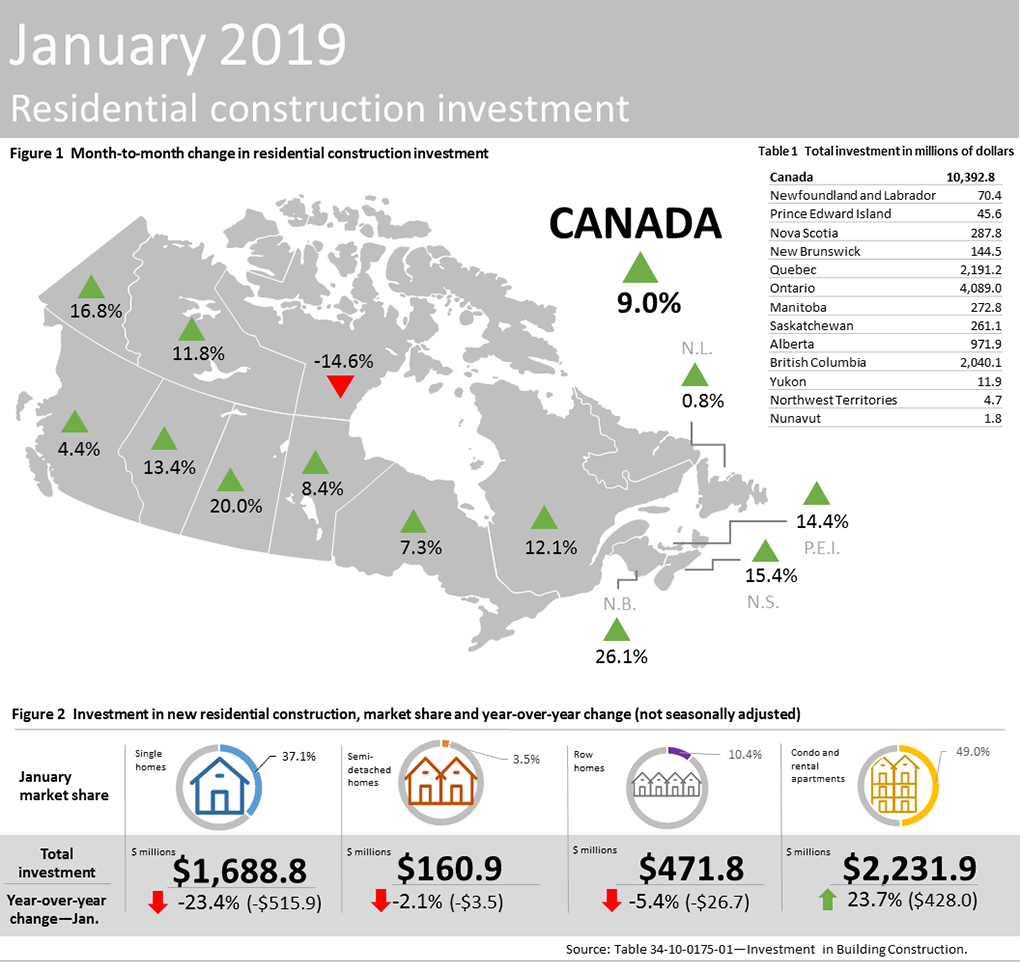

The increase in total residential investment in January was broad based, with every province and territory increasing except Nunavut (-14.6%). Gains for the month were led by Ontario (+$277 million), Quebec (+$236 million) and Alberta (+$115 million).

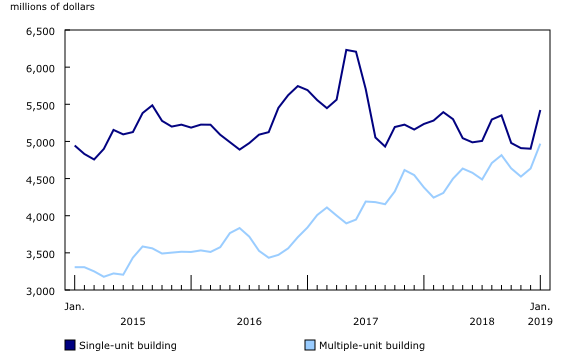

In the residential sector, investment in single-dwelling construction broke from the downward trend set over the last three months of 2018, up 10.6% in January to $5.4 billion. At the same time, investment in multiple dwelling construction (which includes doubles, row homes, and condo and rental apartments) continued to build its upward momentum, rising 7.2% to $5.0 billion.

Residential investment in focus: Montréal, Toronto and Vancouver

On an unadjusted basis, Canada's three largest municipalities posted strong year-over-year growth in total residential investment (Montréal +26.1%, Vancouver +18.1%, Toronto +8.6%) in January.

This growth was primarily concentrated in the multiple dwelling component, as builders focused investment in the construction of new condo and rental apartments (Toronto +$140 million, Vancouver +$139 million, Montréal +$79 million).

At the same time, while each of the major metropolitan centres saw lower investment in the construction of new single family homes (Toronto -$140 million, Vancouver -$63 million, Montréal -$6 million), the renovation market mostly offset that weakness (Toronto +$126 million, Montréal +$91 million, Vancouver +$18 million).

Investment in non-residential building construction

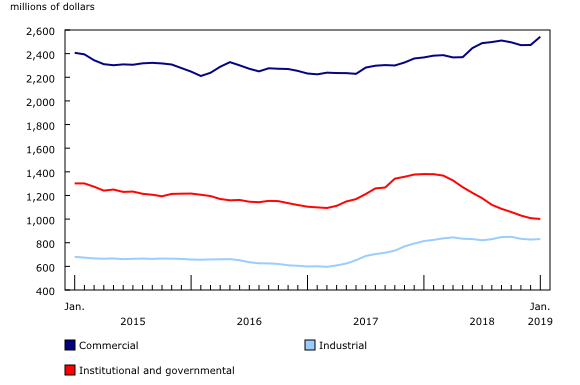

Gains in the non-residential sector in January were concentrated primarily in Quebec (+$36 million) and British Columbia (+$23 million). Investment in the remaining provinces and territories rose by $8 million to $2.8 billion.

By component, the gain in January was attributable to a 2.8% increase in investment in commercial buildings, reaching a record high $2.5 billion for the monthly series. The industrial component edged up 0.5% to $831 million, which was offset by a corresponding small decline in institutional investment (-0.7% to $1.0 billion).

Non-residential investment in focus: Montréal, Toronto and Vancouver

By contrast, the picture for non-residential investment was more varied than in the residential sector. On an unadjusted basis, total non-residential investment in Montréal rose 10.4% year over year in January to $547 million, on gains in the commercial (+$33 million) and industrial (+$17 million) components.

Toronto saw a significant decline in the non-residential sector (-17.8%), with all three components down in January compared with the same month a year earlier. The downward movement in investment was mainly the result of a $130 million decline in institutional spending due to maturing hospital projects (Mackenzie Vaughan and Mount Sinai), followed by declines in industrial (-$28 million) and commercial (-$28 million) investment.

On the West Coast, non-residential investment in Vancouver rose 22.9% on strength in the commercial component (+$90 million), which was partially offset by small declines in institutional (-$8 million) and industrial (-$7 million) investment.

Note to readers

Data presented in this release are seasonally adjusted and are expressed in current dollars unless otherwise stated. Using seasonally adjusted data facilitates month-to-month comparisons by removing the effects of seasonal variations. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Monthly estimates for constant dollars are calculated using quarterly deflators from the Building Construction Price Index (18-10-0135-01). Typically, the first two months of a quarter use the previous quarters' price level and are revised when the new quarterly price index becomes available.

Detailed data on investment activity by type of building and type of work are now available in the unadjusted current dollar series.

As a result of data source constraints, the total value for "type of work – all" may not equal the sum of its parts (new construction, renovation, conversion, and other). The component required to complete the summation is "type of structure, minor."

In the type of work series "conversions total," one or more residential dwelling units are created from an existing structure. Deconversions, garages and carports, as well as in-ground swimming pools, are grouped together in the "other types of work" category.

Prior to January 2018, building permits for cottages with a value greater than $60,000 were automatically reclassified to structure type Single. Beginning with January 2018, regardless of value, building permits received from municipalities coded as cottages remain classified as a cottage.

Effective November 23, 2018, table 34-10-0175-01 contains data on both the residential and non-residential sector. It replaced tables 34-10-0010-01, 34-10-0011-01 and 34-10-0012-01.

Next release

Data on investment in building construction for February will be released on April 23.

Products

Statistics Canada has a new Housing Market Indicators Dashboard. This web application provides access to key housing market indicators for Canada, by province and by census metropolitan area. These indicators are automatically updated with new information from monthly releases, giving users access to the latest data.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: