Canada's international transactions in securities, September 2018

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2018-11-16

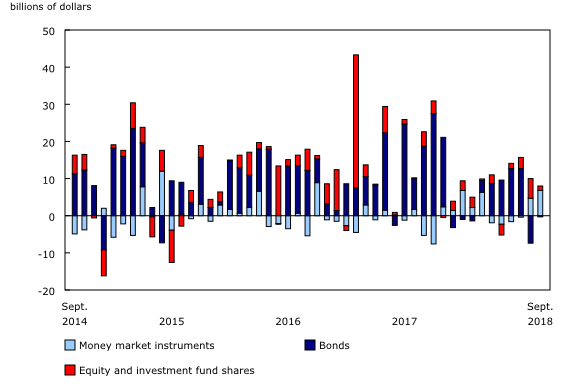

Foreign investment in Canadian securities totalled $7.7 billion in September, mainly acquisitions of money market instruments. At the same time, Canadian investment in foreign securities resumed to reach $10.6 billion, led by purchases of non-US instruments.

As a result, international transactions in securities generated a net outflow of funds of $2.9 billion from the Canadian economy in September. For the third quarter, portfolio investment generated a net inflow of funds in the economy of $2.4 billion, the lowest in nearly three years.

Foreign investors target the Canadian money market

Foreign investment in Canadian securities increased to $7.7 billion in September, up from $2.6 billion in August. The investment activity in September mainly targeted the Canadian money market.

From January to September, foreign purchases of Canadian securities totalled $73.5 billion, compared with $144.6 billion for the same period in 2017. Foreign investors decreased their holdings of government bonds by $31.8 billion from January to September 2018, compared with total investments of $40.6 billion for the same period in 2017.

Non-resident investors strengthened their acquisitions of Canadian money market instruments by adding $6.8 billion to their holdings in September, the largest investment since October 2016. Foreign acquisitions of Canadian Treasury bills and provincial government paper accounted for most of the investment activity. Canadian long-term interest rates increased by 10 basis points and short-term interest rates were down by 3 basis points in September. Meanwhile, the Canadian dollar appreciated slightly against its US counterpart.

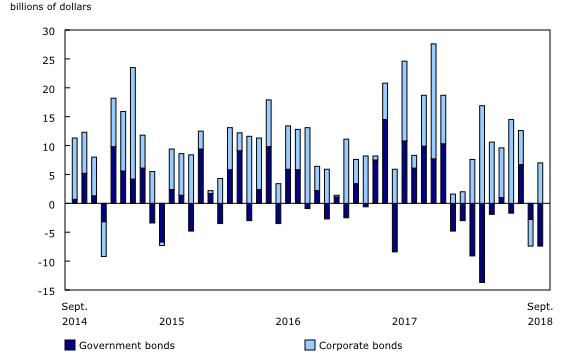

Foreign investors reduced their holdings of Canadian bonds by $339 million in September, a second consecutive month of divestment. Activity in the month reflected sales of government bonds ($7.4 billion), both federal and provincial, moderated by purchases of corporate bonds ($7.0 billion).

Foreign investment in Canadian equities amounted to $1.2 billion in September, the lowest investment in four months. For the third quarter, foreign purchases totalled $9.5 billion, the highest quarterly investment since the first quarter of 2017. Canadian stock prices were down by 1.2% in September and by 1.3% in the quarter.

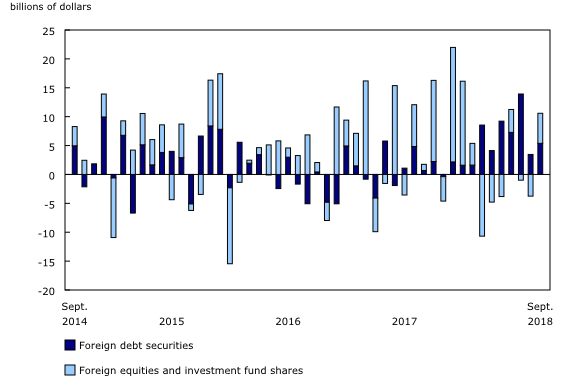

Canadian investment in foreign securities resumes

Canadian investors resumed their acquisitions of foreign securities with purchases totalling $10.6 billion in September, mainly non-US foreign instruments. This followed a divestment of $288 million in August. Investors purchased an equivalent amount of foreign bonds and foreign shares in September.

From January to September, Canadian investment in foreign securities totalled $58.6 billion, compared with $51.0 billion for the same period in 2017. Canadian investors largely targeted foreign bonds in 2018 as opposed to US shares in 2017.

Canadian investment in foreign debt securities amounted to $5.4 billion in September, up from a $3.5 billion investment in August. The bulk of the activity in September was in non-US foreign bonds. US short-term interest rates increased by 10 basis points, and US long-term rates were up by 11 basis points in the month.

Canadian investment in foreign equities rebounded to reach $5.2 billion in September, following two consecutive month of divestment. This was the highest investment since January 2018. Acquisitions in the month targeted US and non-US shares. US stock prices edged up in September.

Note to readers

The data series on international transactions in securities covers portfolio transactions in equity and investment fund shares, bonds and money market instruments for both Canadian and foreign issues. This activity excludes transactions in equity and debt instruments between affiliated enterprises, which are classified as foreign direct investment in the international accounts.

Equity and investment fund shares include common and preferred equities, as well as units/shares of investment funds.

Debt securities include bonds and money market instruments.

Bonds have an original term to maturity of more than one year.

Money market instruments have an original term to maturity of one year or less.

Government of Canada paper includes Treasury bills and US-dollar Canada bills.

All values in this release are net transactions unless otherwise stated.

Next release

Data on Canada's international transactions in securities for October will be released on December 17.

Products

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available. This publication will be regularly updated to maintain its relevance.

The updated Canada and the World Statistics Hub (13-609-X) is available online. This product illustrates the nature and extent of Canada's economic and financial relationship with the world using interactive graphs and tables. This product provides easy access to information on trade, investment, employment and travel between Canada and a number of countries, including the United States, the United Kingdom, Mexico, China and Japan.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

To enquire about the concepts, methods or data quality of this release, contact Éric Simard (613-219-5932; eric.simard@canada.ca), International Accounts and Trade Division.

- Date modified: