Oil and gas extraction, 2017

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2018-09-24

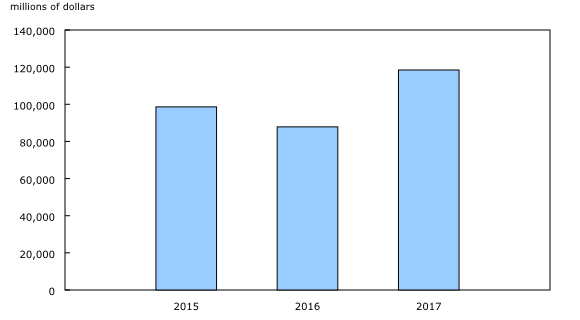

Total revenue for the Canadian oil and gas extraction industry increased 34.9% to $118.5 billion in 2017, following a 10.9% decline in 2016.

Meanwhile, total expenses and deductions decreased 10.2% to $109.6 billion, resulting in a net gain of $8.9 billion in 2017, compared with a net loss of $34.1 billion in 2016.

Higher prices were a contributing factor to the increase in revenue in 2017. According to the Raw Materials Price Index, the average annual price of crude oil and crude bitumen increased 19.4% year over year, compared with an 8.0% decrease in 2016. Meanwhile, the average annual price of natural gas increased 8.7% in 2017, compared with a 12.0% decline in 2016.

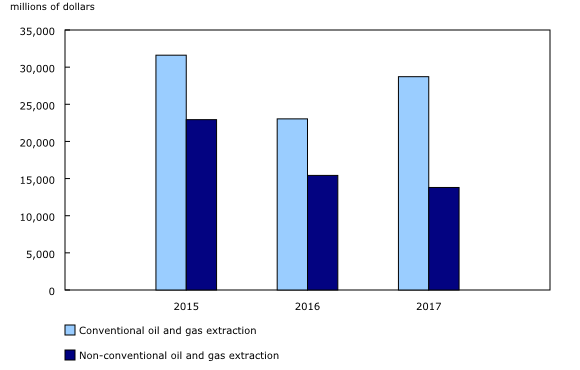

Capital and operating expenditures up

Overall, capital expenditures in the oil and gas extraction industry rose 10.5% to $42.5 billion in 2017. The gain was attributable to a 24.7% increase in capital spending by the conventional oil and gas extraction sector, which was partly offset by a 10.5% drop in spending by the non-conventional oil and gas extraction sector to $13.8 billion.

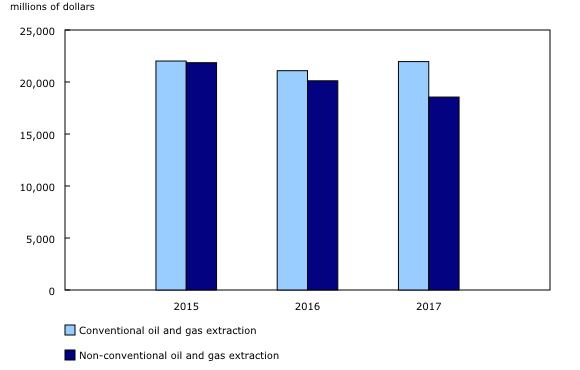

Total operating costs decreased 1.7% to $40.5 billion in 2017, following a 6.1% decline in 2016. Operating costs in the conventional oil and gas extraction sector increased 4.1% to $22.0 billion, while costs in the non-conventional oil and gas extraction sector were down 7.8% to $18.6 billion.

Royalty payments totalled $6.6 billion in 2017, up 56.7% from $4.2 billion in 2016.

Volume and value of marketable production rises

Production volumes for crude oil, equivalent products and natural gas continued to increase in 2017. Over the same period, the overall value of these products rose 32.5% to $107.4 billion.

Production of crude oil and equivalent products was up 7.9% to 230.8 million cubic metres in 2017, the eighth consecutive annual increase. Meanwhile, the market value of these products rose 34.4% to $83.0 billion.

Marketable production of natural gas increased 4.0% to 166.3 billion cubic metres and the value increased 10.1% to $13.6 billion in 2017. Over the same period, production of natural gas by-products rose 6.2% to 48.7 million cubic metres, while the value of these products increased 56.1% to $10.9 billion. The increase was primarily driven by higher industrial prices.

Total assets increase

Canadian oil and gas extraction companies reported $573.9 billion in total assets in 2017, up 2.1% compared with 2016. The increase in total assets was mainly attributable to a 4.6% gain in net capital assets to $453.6 billion.

Over the same period, current liabilities rose 20.8% while equity decreased 5.8%.

Note to readers

The Annual Oil and Gas Extraction Survey program disseminates its data in tables 25-10-0064-01 (oil and gas extraction capital expenditures and operating costs) and 25-10-0065-01 (oil and gas extraction revenues, expenses and balance sheet) starting with the 2015 reference year.

The oil and gas extraction industry includes establishments primarily engaged in operating oil and gas field properties. This includes the production and extraction of oil from oil shale and oil sands.

Crude oil and equivalent products include crude oil, crude bitumen, synthetic crude oil and condensate.

Conventional oil and gas extraction includes establishments primarily engaged in the production of petroleum or natural gas from wells in which the hydrocarbons will initially flow or can be produced using normal pumping techniques.

Non-conventional oil and gas extraction includes establishments primarily engaged in producing crude oil from surface shales, oil sands or from reservoirs in which the hydrocarbons are semisolids and conventional production methods are not possible.

Natural gas by-products include ethane, propane, butane and pentanes plus. Elemental sulphur is not included.

Other assets include all assets not reported as either current or capital assets.

Other liabilities include all liabilities not reported as either a current liability or long-term debt.

Raw Materials Price Index

Data for the Raw Materials Price Index were taken from table 18-10-0034-01.

Data for 2016 have been revised.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: