Foreign direct investment, 2015

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2016-04-26

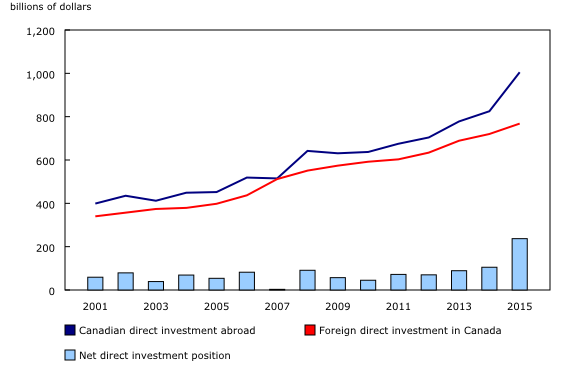

The stock of Canadian direct investment abroad rose 21.8% to $1,005.2 billion in 2015, the largest increase since 2008. At the same time, the level of foreign direct investment in Canada was up 6.8% to $768.5 billion. As a result, Canada's net direct investment position with the rest of the world more than doubled to $236.8 billion in 2015.

The increase in the stock of Canadian direct investment abroad in 2015 largely reflected the impact of a weaker Canadian dollar, which added $115.8 billion to the value of these assets. The Canadian dollar continued to lose ground against the US dollar (-19%) in 2015 and depreciated against the British pound (-13%) and the euro (-7%). The growth in the value of foreign direct investment in Canada was more subdued and mainly reflected investment flows over the year.

Increase in Canadian direct investment abroad focused in the United States

The United States accounted for almost two-thirds of the increase in Canadian direct investment abroad in 2015, as the investment position in that country rose 31.0% to $448.5 billion. As a result, the United States' share of total Canadian direct investment abroad increased from 41.5% in 2014 to 44.6% in 2015.

Other countries with significant gains in Canadian direct investment abroad during the year included the United Kingdom, up 32.6% to $92.9 billion; Barbados, up 13.6% to $79.9 billion; and the Cayman Islands, up 36.7% to $48.7 billion.

Direct investment in Chile posted the only significant decline, down 27.1% to $15.1 billion.

United States behind most of the increase in foreign direct investment in Canada

The United States was the major contributor to the overall growth in the stock of foreign direct investment in Canada in 2015, as that country's investment position rose 10.5% to $387.7 billion.

Other notable gains were recorded for the Netherlands, up 18.7% to $89.1 billion, and Spain, up 362.8% to $10.2 billion. These increases were moderated by declines in the investment position for Switzerland, down 47.4% to $12.3 billion, and the United Kingdom, down 16.8% to $34.3 billion.

Growth in Canadian direct investment abroad focused on the finance and insurance, management, and manufacturing sectors

On a sector basis, the finance and insurance sector was the major contributor to the increase in Canadian direct investment abroad in 2015, rising 30.0% to $417.3 billion. This sector remained the primary destination for Canadian direct investment abroad, accounting for 41.5% of the overall position at the end of 2015. Other sectors with notable increases during the year included management of companies and enterprises, which was up 20.4% to $119.3 billion, and manufacturing, which rose 33.5% to $75.5 billion.

Major contributors to the overall increase in foreign direct investment in Canada on a sector basis were management of companies and enterprises, up 12.4% to $138.3 billion; professional, scientific and technical services, up 101.0% to $22.1 billion; and manufacturing, up 3.5% to $205.0 billion

Note to readers

This is the annual release of detailed foreign direct investment data at book value. This release contains country and industry details for foreign direct investment that are drawn from the annual survey. This detailed information is not available at the time of quarterly international investment position releases. However, aggregates of direct investment positions, both at book and market values, are available as part of the quarterly international investment position release. The current aggregates at book value, along with revised aggregates at market value, will be integrated into the international investment position at the time of the third quarter 2016 release in December, in line with the Canadian System of Macroeconomic Accounts revision policy.

Direct investment is a component of the international investment position that refers to the investment of an entity in one country (the direct investor) obtaining a lasting interest in an entity in another country (the direct investment enterprise). The lasting interest implies the existence of a long-term relationship between the direct investor and the direct investment enterprise and a significant degree of influence by the direct investor on the management of the direct investment enterprise.

In practice, direct investment is deemed to occur when a direct investor owns at least 10% of the voting equity in a direct investment enterprise. This report presents the cumulative year-end positions for direct investment, measured as the total value of equity and the net value of debt instruments between direct investors and their direct investment enterprises.

Foreign direct investment by country and by industry

Following international standards, direct investment is based on the country of residence of the direct investor (immediate parent company) for foreign direct investment in Canada and to the country of residence of the direct investment enterprise (the immediate subsidiary) for Canadian direct investment abroad. This implies that direct investment is largely attributed to the first investor/investee country, rather than the ultimate investor/investee country. Direct investment is often channelled through intermediate holding companies or other legal entities in other countries before reaching its ultimate destination. Since these entities are generally in the financial sector, this sector accounts for a larger share of foreign direct investment on an immediate country basis than it would on an ultimate country basis.

Currency valuation

The value of Canadian direct investment abroad is denominated in foreign currency and converted to Canadian dollars at the end of each period for which a year-end position is calculated. When the Canadian dollar is depreciating in value, the restatement of the value of direct investment abroad in Canadian dollars increases the recorded value. The opposite is true when the dollar is appreciating. Foreign direct investment in Canada is directly recorded in Canadian dollars and the fluctuation of the Canadian dollar has no impact on the recorded value.

Data quality

In general, data for smaller countries and industries (defined as countries with foreign direct investment below $500 million or industries at the three-digit level of the North American Industry Classification System) are subject to higher sampling variability.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

To enquire about the concepts, methods or data quality of this release, contact Marc Atkins (613-790-7739; marc.atkins@canada.ca), International Accounts and Trade Division.

- Date modified: