Consumer Price Index: Annual review, 2015

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2016-01-22

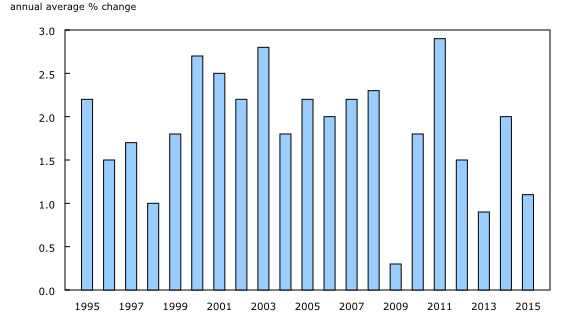

In 2015, the annual average increase in the Consumer Price Index (CPI) was 1.1%. This increase followed gains of 2.0% in 2014 and 0.9% in 2013.

Decreases in gasoline prices contribute to slower growth in consumer prices in 2015

On an annual average basis, consumers paid 16.5% less for gasoline than they did the previous year, marking the largest annual average decrease in the gasoline index since 2009. The decline in the gasoline index followed price increases in 2014 (+0.2%) and 2013 (+0.6%).

Excluding gasoline, the annual average rise in the CPI was 2.0% in 2015, following a 1.9% increase the previous year.

A mixed bag of price changes among the major components in 2015

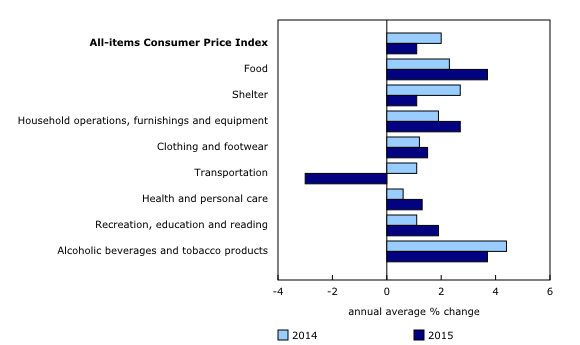

Prices were up on an annual average basis in seven of eight major components in 2015. The transportation index was the only major component to decrease in 2015.

Food prices were up 3.7% on an annual average basis in 2015, after rising 2.3% in 2014. The increase in food prices was led by a rise in meat prices, which were up 7.6% in 2015. In particular, beef prices rose 15.1%, their largest increase since 2001. Additionally, consumers paid more on average for fresh vegetables (+8.1%) and fresh fruit (+6.3%) in 2015 than they did in 2014. Prices for food purchased from restaurants rose 2.7% in 2015.

The household operations, furnishings and equipment index increased 2.7% on an annual average basis in 2015, after rising 1.9% the previous year. This acceleration was led by the furniture index, which was up 3.1% in 2015, its largest increase since 1999. Additionally, prices for household appliances rose 4.0% in 2015, after decreasing 0.7% in 2014.

On an annual average basis, the shelter index was up 1.1% in 2015, after increasing 2.7% the previous year. This deceleration was mainly attributable to natural gas prices, which were down 6.4% in 2015, after rising 16.8% the previous year. Fuel oil prices decreased 19.3% in 2015, after increasing 5.1% in 2014. In contrast, homeowners' home and mortgage insurance costs were up 8.8% on an annual average basis in 2015.

Transportation costs were down 3.0% on an annual average basis in 2015, after increasing 1.1% the previous year. The gasoline index led this decline. In contrast, consumers paid 1.6% more for the purchase of passenger vehicles in 2015 compared with 2014.

Consumer prices rise at slower rates in eight provinces

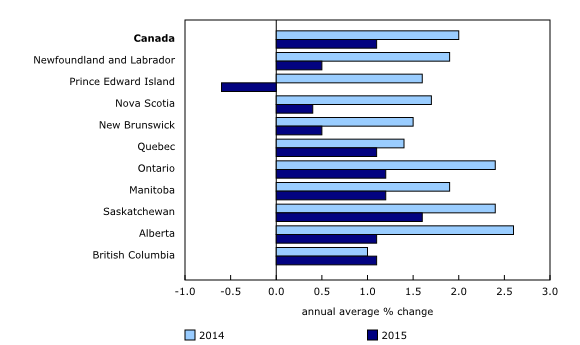

Among the provinces, eight posted smaller annual average increases in consumer prices in 2015 than in 2014. Prices in British Columbia increased more on an annual average basis in 2015 than they did the previous year, while Prince Edward Island was the lone province to register a decrease in its annual average CPI. The largest annual average gain in consumer prices was recorded in Saskatchewan (+1.6%), followed by Ontario (+1.2%) and Manitoba (+1.2%).

The gasoline index was the largest downward contributor to the annual average change in the all-items CPI of each province.

The Bank of Canada's core index

On an annual average basis, the Bank of Canada's core index increased 2.2% in 2015, following a 1.8% rise in 2014.

Note to readers

This release examines the percentage change between the annual average Consumer Price Index (CPI) in 2015 and 2014. Annual average indexes are obtained by calculating the average of the 12 monthly index values over the calendar year. Annual average percent change should not be confused with the 12-month percent change that is published every month with the release of the CPI. Unlike annual average change, 12-month change compares the monthly index level with the level from the same month a year earlier.

The Bank of Canada's core index excludes eight of the CPI's most volatile components (fruit, fruit preparations and nuts; vegetables and vegetable preparations; mortgage interest cost; natural gas; fuel oil and other fuels; gasoline; inter-city transportation; and tobacco products and smokers' supplies) as well as the effects of changes in indirect taxes on the remaining components.

Products

The December 2015 issue of The Consumer Price Index, Vol. 94, no. 12 (62-001-X), is now available from the Browse by key resource module of our website under Publications.

More information about the concepts and use of the Consumer Price Index are available online in The Canadian Consumer Price Index Reference Paper (62-553-X) from the Browse by key resource module of our website under Publications.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: