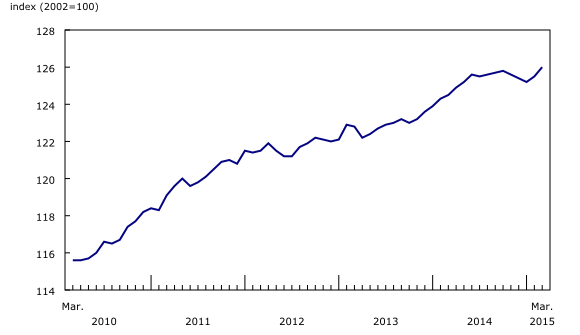

Consumer Price Index, March 2015

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2015-04-17

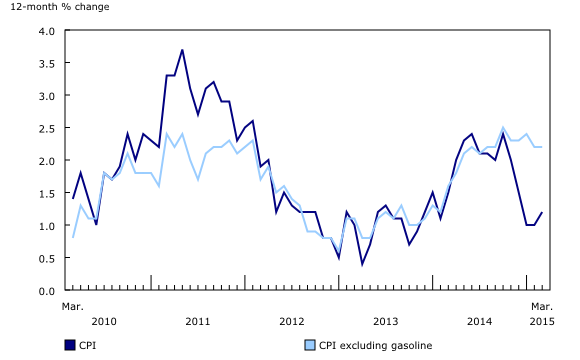

The Consumer Price Index (CPI) rose 1.2% in the 12 months to March, after increasing 1.0% in February.

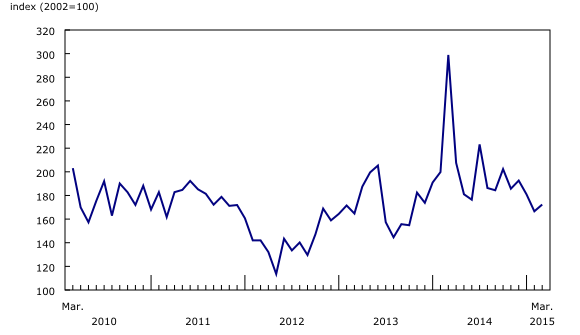

Lower gasoline prices continued to be the largest downward contributor to the CPI in the 12 months to March, posting a 19.2% decline. However, the decline in March was smaller than the 21.8% year-over-year decrease observed in February.

Excluding gasoline, the CPI increased 2.2% on a year-over-year basis in March, matching the rise the previous month.

On a non-seasonally adjusted monthly basis, the gasoline price index rose 6.3% in March, following a 9.4% gain the previous month.

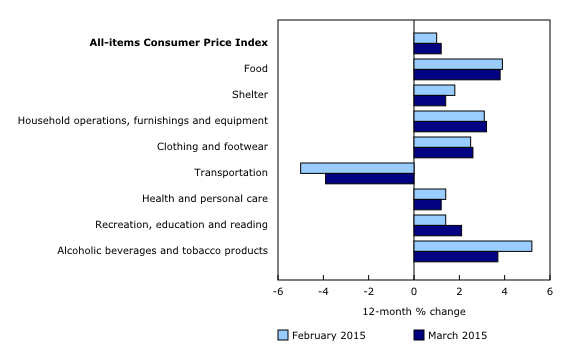

12-month change in the major components

Prices rose in seven of the eight major components in the 12 months to March, led by higher prices for food, followed by increases in the household operations, furnishings and equipment index and the shelter index. The transportation index, which includes gasoline, posted its fifth consecutive year-over-year decline.

Consumers paid 3.8% more for food in March compared with the same month a year earlier. Prices for food purchased from stores were up 4.2% on a year-over-year basis, led by an 11.8% increase in meat prices. Higher prices for fresh vegetables (+6.4%) and fresh fruit (+2.1%) also contributed to the gain. Prices for food purchased from restaurants rose 2.8% year over year in March.

Shelter costs rose 1.4% year over year in March, led by the homeowners' home and mortgage insurance index, which was up 9.1%. Consumers also paid more for rent (+1.4%), property taxes (+2.2%) and electricity (+3.0%). In contrast, fuel oil prices were 15.2% lower in March compared with the same month the previous year.

Transportation costs decreased 3.9% in the 12 months to March, after falling 5.0% in February. Lower gasoline prices were the largest downward contributor in both months. Conversely, prices for the purchase of passenger vehicles rose 1.8% year over year in March, following a 1.0% decline the previous month.

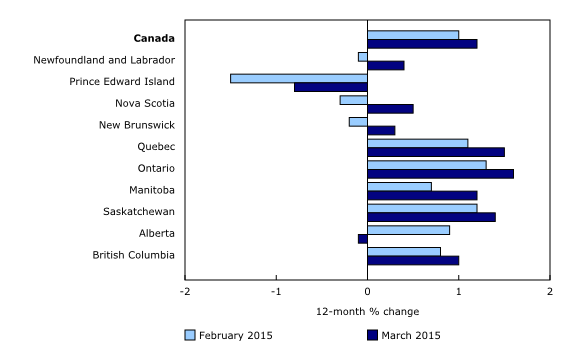

12-month change in the provinces

Consumer prices rose in eight provinces in the 12 months to March, with Ontario posting the largest increase. Among the Atlantic provinces, three recorded year-over-year gains in their CPIs in March, following declines the previous month. Prince Edward Island was the exception, recording its fourth consecutive decline. Consumer prices in Alberta also decreased year over year.

Year-over-year declines in gasoline prices were observed in every province.

Ontario's CPI rose 1.6% in March compared with the same month a year earlier. Natural gas prices were up 25.7% in the province in the 12 months to March. This year-over-year increase mainly reflected a 33.6% monthly rise in natural gas prices in April 2014, which followed prolonged cold weather. In addition, on a year-over-year basis, the index for homeowners' home and mortgage insurance increased more in Ontario than at the national level.

Nova Scotia (+0.5%), Newfoundland and Labrador (+0.4%) and New Brunswick (+0.3%) posted increases in consumer prices in the 12 months to March. At the same time, Prince Edward Island's CPI decreased 0.8% on a year-over-year basis in March, a smaller decrease than in February. In all of the Atlantic provinces, prices for fuel oil, which is used extensively for home heating in the region, posted smaller year-over-year declines in March than in the previous month. The effect of the decline in fuel oil prices was greatest in Prince Edward Island, where the basket weight of fuel oil is 10 times larger than at the national level.

Consumer prices in Alberta decreased 0.1% in the 12 months to March, led by a 42.4% fall in natural gas prices, which tend to be volatile in the province. The year-over-year decline in natural gas prices in March reflected a spike in Alberta's natural gas index in March 2014, when prices rose 49.6% on a monthly basis. In addition to paying less for natural gas on a year-over-year basis in March, consumers in Alberta paid 12.4% less for electricity.

Seasonally adjusted monthly Consumer Price Index increases

On a seasonally adjusted monthly basis, the CPI increased 0.4% in March, following a 0.2% rise in February.

Of the eight major components, six increased and one declined on a seasonally adjusted monthly basis in March. The seasonally adjusted index for clothing and footwear posted no change, indicating that the 3.3% monthly rise in the unadjusted index was typical for March.

The seasonally adjusted transportation index rose 0.8% on a monthly basis in March, following a 0.7% increase in February. Before seasonal adjustment, the transportation index rose 1.9% in March.

On a seasonally adjusted monthly basis, the recreation, education and reading index rose 0.4% in March. In contrast, the seasonally adjusted index for health and personal care declined 0.2%.

Bank of Canada's core index

The Bank of Canada's core index increased 2.4% in the 12 months to March, after rising 2.1% in February.

The seasonally adjusted core index rose 0.4% on a monthly basis in March, following a 0.1% increase in February.

Note to readers

A seasonally adjusted series is one from which seasonal movements have been eliminated. Users employing Consumer Price Index (CPI) data for indexation purposes are advised to use the unadjusted indexes. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

The Bank of Canada's core index excludes eight of the CPI's most volatile components (fruit, fruit preparations and nuts; vegetables and vegetable preparations; mortgage interest cost; natural gas; fuel oil and other fuels; gasoline; inter-city transportation; and tobacco products and smokers' supplies) as well as the effects of changes in indirect taxes on the remaining components.

Products

For a more detailed report, consult the publication The Consumer Price Index. The March 2015 issue of The Consumer Price Index, Vol. 94, no. 3 (62-001-X), is now available from the Browse by key resource module of our website under Publications.

More information about the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the first century of Canada's Consumer Price Index (62-604-X).

A video providing an overview of the CPI is available on Statistics Canada's YouTube channel.

The CPI for April will be released on May 22.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (613-951-4636; statcan.mediahotline-ligneinfomedias.statcan@canada.ca).

- Date modified: